Whether small, medium, or large, businesses of all scales require business expense tracking apps. Rent, utilities, furniture, inventory, licenses, insurance, marketing, and staff. These assets incur expenses for your business in one way or another. Thus, tracking all your costs is essential to staying within budget and successfully running your organization.

However, not every business has access to the best-fit business expense tracker solutions. Either they have picked the wrong software or don’t know what to look for in such tools.

So, in today’s post, we will tell you all about the business expense tracking apps and more. So, let’s begin.

Comparing the Top 15 Business Expense Tracking Apps for 2026

| Software Name | Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| DeskTrack | Cutting time expense | $5.99/user/month | 15 days | 5/5 |

| Zoho Expense | Travel and expense management | $0.89/user/month | 14 days | 4.9/5 |

| Rydoo | Global expenses | $9/user/month | 14 days | 4.8/5 |

| Emburse Professional | Virtual expenses | Quote on contact | 14 days | 4.7/5 |

| QuickBooks Online | All-in-one accounting | $8/user/month + $10/month base fee | 30 days | 4.6/5 |

| FreshBooks | Freelancers | $185.98/year | 30 days | 4.4/5 |

| SAP Concur Expense | Customized solution | Quote on contact | 15 days | 4.4/5 |

| Expensify | Dedicated expense cards | Quote on contact | Up to 6 weeks | 4.3/5 |

| Everlance | Tracking tax deductions | $69.99/year | 7 days | 4.2/5 |

| Shoeboxed | Paper receipts | $18/month | 30 days | 4.1/5 |

| Xero | Small businesses | $29/month | 30 days | 4.4/5 |

| Rippling | Automated workflow approvals | Quote on contact | Free Demo | 4.8/5 |

| Airbase | Payable automation | Quote on contact | Free plan | 4.8/5 |

| Navan | User experience | Quote on contact | Free plan | 4.7/5 |

| Webexpenses | Mileage tracking | $15.50/user/month | 14 days | 4.4/5 |

Business Expense Tracking & Optimization Checklist

Download this accurate and reliable Business Expense Tracking & Optimization Checklist to identify the specific bottlenecks holding your performance back today!

What is Business Expense Tracking?

In short, tracking business expenses can mean tracking, recording, and organizing the spending of your business. These expenses can be bills, fees, and other costs. One of the reasons why tracking business costs is essential is because of the tax-deductibility of some expenses. Accurately tracking your expenses can help you:

- Decrease taxes

- Monitor budget

- Determine business profitability

Sure, it’s possible to track these expenses manually. However, business expense tracking apps ensure that you don’t get the headache of more than enough complex paperwork.

Start Saving Time & Costs Today ➡

What are Business Expense Tracking Apps?

In short, software for tracking business expenses is a feature-rich tool package. Such apps help individuals and businesses monitor, record, and manage their expenses. Overall, it’s a convenient way to track spending, categorize costs, make reports, and ensure tax regulation compliance.

Furthermore, business expense tracking apps provide you with many functionalities and tools, including receipt scanning, mileage tracking, and expense categorization, to simplify income and expense management.

How Do Business Expense Tracking Apps Work?

Here’s a breakdown of how expense management applications function.

- The apps import all expenses, helping you keep track of the amount you spend and where.

- Going from simple to advanced, the features include bank account integration for importing transactions, receipt scanning and categorization, and credit card syncing.

- The app helps you improve budgeting by helping you track and categorize spending.

- Automated receipt scanning and analysis are handy for businesses that reimburse employees.

- To see a quick overview of your business or personal expenses, use the report generation feature.

Why Do You Need Business Expense Tracking Apps?

There are many benefits of using expense tracker software. Other than the fact that it eliminates pen and paper use, there are many reasons why you need such apps. Plus, the fact that these apps can save you 15-20% (from multiple sources) is amazing.

- They have user-friendly interfaces.

- These apps provide anytime and anywhere accessibility.

- Expense apps automate receipt scanning.

- They simplify expense entry processes.

- Using apps for tracking business expenses reduces errors.

How to Choose the Right Business Expense Tracker in 2026?

When looking for tools for tracking business expenses. Especially for an expense tracker for small businesses, thorough requirement analysis is the key to identifying the best-fit solution. You have many needs in your organization. To fulfill these requirements, you need to look for these features.

1. Income & Expense Tracking

- Using the right business expense tracking app will never let you lose sight of your income and expenses with real-time tracking.

- It can synchronize well with your credit cards and bank accounts to seamlessly track transactions.

2. Receipts Organization

- Choose an app that can accurately scan receipts and even organize them across multiple categories.

- It must also have a user-friendly interface to ensure that you can easily find the receipt you are looking for.

3. Tax Organization

- The right expense tracker tool also simplifies tax details and management.

- You can keep track of tax returns, due dates, and everything related from a single platform.

4. Invoice & Payment Management

- The right expense application also makes invoice and payment management easy.

- You can check invoice status and due payments in real-time.

5. Report Management

- The app provides you with detailed expense reports.

- These help you spot spending habits and save costs.

6. Providing Secure Access

- The right application for monitoring costs also provides you with security features to ensure that your financial data is safe.

- This gives you a surety that your budget and related information never gets into the wrong hands.

7. Analytics & Insights

- The tool also provides you with detailed insights regarding budgets, spending, and expenses.

- This data helps you spot trends in whether the expenses increased or decreased in a given time bracket.

8. Workflow Automation

- Advanced business expense management apps also provide AI-powered features to automate workflows.

- For instance, you can automate cost monitoring and reporting, which shifts your focus to more important work.

How About Saving Both Time & Expenses?

Implement DeskTrack today and maximize your employees’ work-time utilization efficiency.

Top 15 Business Tracking Apps in 2026

So that’s all you need to look for in a business expense management solution. However, still finding the best-fit solution for your business can be overwhelming. Since we know that the best way to track business expenses is to use software or applications, here are the top 15 apps for this purpose to give you a heads-up.

- DeskTrack

- Zoho Expense

- Rydoo

- Emburse Professional

- QuickBooks Online

- FreshBooks

- SAP Concur Expense

- Expensify

- Everlance

- Shoeboxed

- Xero

- Rippling

- Airbase

- Navan

- Webexpenses

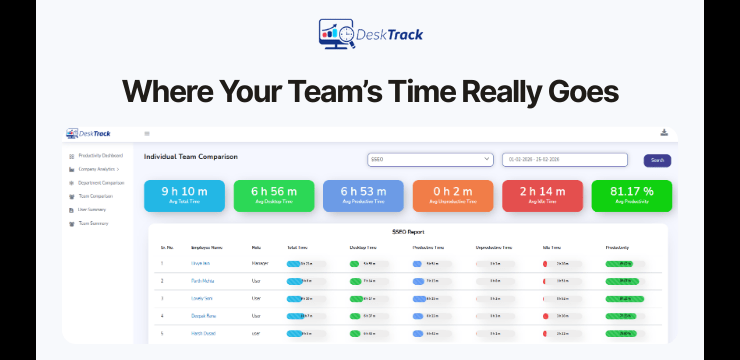

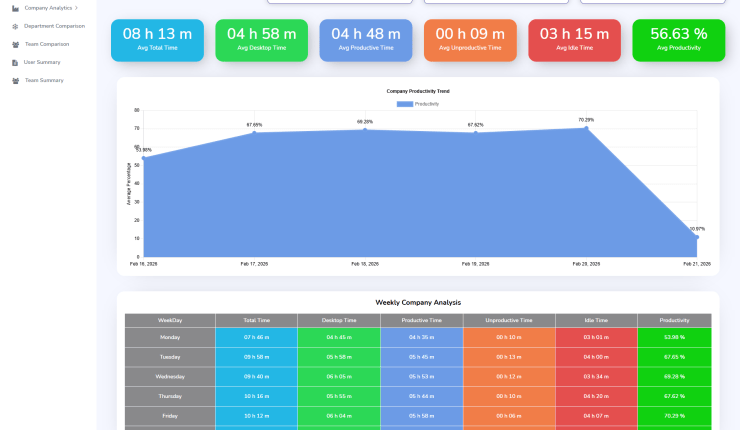

1. DeskTrack

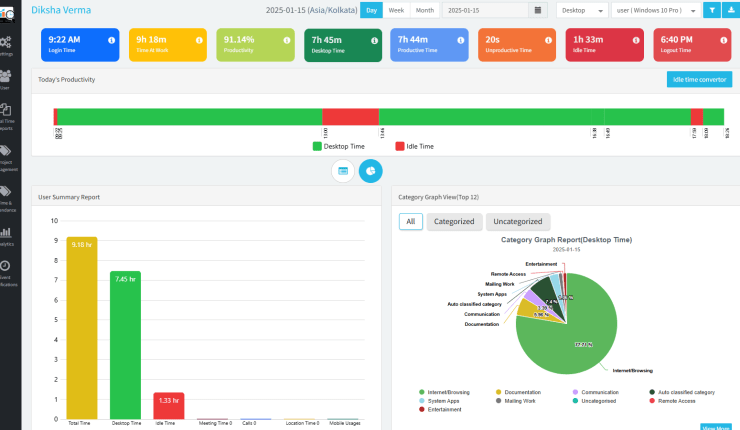

There’s a reason why DeskTrack sits at the top of our business expense tracking apps list. Although it’s not an expense tracking tool, it saves your most valuable cost, that is, time. It’s your complete time tracking package with the most intuitive, integrable, and customizable features. Based on the time is money concept, it shows you the gaps that you can fill with detailed productivity insights. Additionally:

- Monthly timesheets show you how much productive time was spent during the workdays.

- Cost reports let you see whether your employees’ productive time and revenue output were more than the cost or not. This is based on idle time, unproductive time, desktop time, and other metrics.

- Track reimbursements in real-time with cost-per km and location in the reimbursement report.

Pros:

- Seamless integrations

- Automated work hours tracking

- User-friendly interface

- Accurate invoicing

Cons:

- Not particularly a business expense tracking app.

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Cutting time expense | $5.99/user/month | 15 days | 4.9/5 |

See How DeskTrack Saves You Time & Money ➡

2. Zoho Expense

This expense management software for businesses provides you with everything you require to monitor your expenses without going over budget. What we like about this one is the automated expense reporting feature that lets employees submit costs anywhere to simplify approvals. However, you can submit only up to 5 receipts per expense.

Pros:

- Easy to use

- Free plan

- Major accounting solution integrations

Cons:

- Limited to 3 users (free plan)

- Maximum 5 receipts/expense

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Travel and expense management | $0.89/user/month | 14 days | 4.9/5 |

3. Rydoo

Rydoo is one of the business expense tracking apps on our list that lets you deny or approve expenses within the app. Furthermore, you can also get automated approval flows based on the rules you set. However, you can only scan up to 15 pages for PDFs or receipts. That, too, is not always accurate.

Pros:

- Real-time cost tracking

- Optimizes reimbursement cycles

- Automated expense approvals

Cons:

- Maximum 15 pages/receipt or PDF

- Inaccurate scanning

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Global expenses | $9/user/month | 14 days | 4.8/5 |

4. Emburse Professional

The best mileage-tracking app for small businesses is Emburse Professional. It provides you with automated report creation. Plus, you also get streamlined approvals and built-in policy control functionalities. What makes it stand out is that it provides 10 methods to scan and upload receipts. However, the lack of workflow management tools is the biggest concern.

Pros:

- Supports 64 languages and 140+ currencies

- ACH reimbursement

- Unlimited cloud receipt storage

Cons:

- No workflow management tools

- No free version

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Virtual expenses | Quote on contact | 14 days | 4.7/5 |

5. QuickBooks Online

Another well-known expense software for small businesses on our list is QuickBooks Online. It’s your complete accounting solution with the best tools for tracking expenses, features, and functionalities. Plus, you can also sync your bank accounts, credit cards, and other accounts for automated expense imports. However, reimbursement only happens through payroll, which sucks.

Pros:

- Built-in cash flow statement

- Automated recurring expenses

- Up to 40 tag groups (expenses)

Cons:

- Up to 25 unique users only

- Reimbursement through payroll only

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| All-in-one accounting | $8/user/month + $10/month base fee | 30 days | 4.6/5 |

6. FreshBooks

Another one of the well-known business expense tracking apps on our list is FreshBooks. What we like about this one is the automated expense update feature through syncing your credit cards and bank accounts. However, there is no in-app reimbursement. That’s one feature less for $10 more for each additional member.

Pros:

- 14 default expense categories

- Supports multiple currencies

- Assignable recurring expenses

Cons:

- $10 extra for each additional team member

- No in-app reimbursement

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Freelancers | $185.98/year | 30 days | 4.4/5 |

7. SAP Concur Expense

Conquer your business expenses with SAP Concur Expense (we couldn’t help but write this pun). What we like about this business expense tracker is that it’s 100% customizable. So, if you are looking for software that fits your ever-changing needs, this is your choice. However, only 3 pages of receipts are analyzed.

Pros:

- Expense capture works in aeroplane mode as well

- Automated reporting

- In-app reimbursement

Cons:

- Up to 9 pages/receipt

- Only 3 receipt pages are analyzed

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Customized solution | Quote on contact | 15 days | 4.4/5 |

8. Expensify

Expensify is one of the business expense tracking apps on our list that ups the ante. How? You get unlimited receipt tracking and expense management with the free plan. What we like about it is the one-click receipt scanning feature. However, it’s very costly if you are not using the Expensify card, and there are only 25 scans/month available with the free plan.

Pros:

- Discounts if you use the Expensify Card

- Separate business and freelance plans

- Tax tracking

Cons:

- Expensive (without the Expensify Card)

- Limited to 25 auto-scans/month (free plan)

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Dedicated expense cards | Quote on contact | Up to 6 weeks | 4.3/5 |

9. Everlance

This business expense manager provides you with unlimited receipt uploads even with its free plan, similar to Expensify. This is a benefit if your business is highly purchase-oriented. Automatically tracking purchases is also possible with credit card syncing. What we like about it is the deduction feature, which lets you find expenses you can reduce from taxes. However, the focus is only on mileage tracking, and only USD support is available.

Pros:

- Separate business and freelance plans

- Unlimited receipt uploads

- Unlimited users

Cons:

- Focuses mainly on mileage tracking

- USD ($) support only

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Tracking tax deductions | $69.99/year | 7 days | 4.2/5 |

10. Shoeboxed

Shoeboxed is one of the business expense tracking apps on our list, which is an ample choice for simplifying the scanning of receipts. All you have to do is make an envelope with all your receipts, and the app will do all the scanning and digitizing for you. However, there are no workflow approval or management tools.

Pros:

- Unlimited file storage

- Unlimited users

- Human-verified data

Cons:

- Up to 300 digital/paper receipts/month

- No in-app reimbursement

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Paper receipts | $18/month | 30 days | 4.1/5 |

11. Xero

Xero is the software for tracking business expenses, which is best for small businesses. Why so? It has customized financial tools and services to streamline expense management. Furthermore, it focuses on simplifying accounting, and essential tools make it an excellent choice.

Pros:

- Extensive integrations

- Comprehensive financial management

- Good choice for small businesses

Cons:

- Additional features in higher-tier plans only

- Limited invoices and bills (early plan)

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Small businesses | $29/month | 30 days | 4.4/5 |

12. Rippling

Rippling is more than one of the business expense tracking apps on our list. It’s primarily a workforce management software that integrates HR, IT, and finance. With Rippling, it becomes simple to manage payroll, employee benefits, expenses, device management, and app provisioning. Not only are all of these features available in one platform, but it also automates and controls spending.

Pros:

- Employee self-service portals

- Automated workflow

- Comprehensive operation-specific features

Cons:

- Steep learning curve

- Time-consuming initial setup

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Automated workflow approvals | Quote on contact | Free Demo | 4.8/5 |

13. Airbase

Looking for a business expense tracker for payable automation? You can never go wrong with Airbase. It’s primarily a spend management platform for simplifying expense management, AP, and corporate card spending. All of this increases financial operations accuracy by reducing manual work. Overall, it’s one of the best tools for automating accounts payable processes.

Pros:

- Seamless integrations

- Real-time visibility into spending

- Comprehensive AP automation

Cons:

- Steep learning curve

- Pricing is not directly available

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Payable automation | Quote on contact | Free plan | 4.8/5 |

14. Navan

Navan is one of the best business expense tracking apps for simplifying tracking expenses, reporting, and agreements. We specifically chose this one because of the unified travel and expense management integration. Plus, with Navan, you get real-time and detailed financial oversight and operational control. Moreover, the user-friendly interface and integration capabilities are like the cherry on the cake.

Pros:

- User-friendly mobile app

- Real-time visibility into spending

- Integrated travel and expense management

Cons:

- Non-transparent pricing

- Dependent on third-party integrations for complete functionality

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| User experience | Quote on contact | Free plan | 4.7/5 |

15. Webexpenses

Want to streamline tracking, managing, and reporting business expenses? Then, you can never go wrong with this business expense software. Webexpenses provides you with ease of use and powerful functionality. Overall, if you want detailed travel expense records, we recommend Webexpenses because of its intuitive mileage tracking feature.

Pros:

- User-friendly mobile app

- Numerous ERP and accounting system integrations

- Comprehensive mileage tracking and verification

Cons:

- Needs at least 3 active users

- Initial setup and implementation take up to 8-10 weeks

| Best For | Most Affordable Paid Plan | Free Trial Availability | User Rating |

| Mileage tracking | $15.50/user/month | 14 days | 4.4/5 |

Business Expense Tracking App Trends to Look Out for in 2026

Business expense tracking apps are getting more intelligent, faster, and more intuitive. With technological advancements, such as AI and machine learning, global financial management is transforming. For example, predictive analysis will help you precisely foretell spending habits, making financial planning more strategic and informed. For adding convenience and functionality, though, mobile app features will do the trick.

Expert Tips to Implement Business Expense Tracking Apps for Organizations

To make it work for you and get the expected results, you need to use your business expense software the right way. Here are some proven tips from our experts that we compiled for you.

1. Evaluate Current Processes & Requirements

Before implementing any software for it, taking a look at your expense management processes is a wise choice. It will help you identify pain points, such as late reimbursements and manual data entry errors. Based on this, list out the requirements for your expense app.

2. Choose the Best App

Based on your requirements, choose the best business expense tracker app with all the features that turn all your pain points into simple solutions. For example, automated reimbursement to ensure that fieldwork staff or any eligible employee gets reimbursed on time with the correct amount. Pair it with your favorite time tracking app, and you know what will happen.

3. Involve Key Stakeholders

When deciding which software will automate expense tracking for you, involve managers, financial experts, and HR. Their input acts as insights, letting you know how practical the chosen tool is.

4. Train Your Employees

Train your employees to effectively use the app for tracking business expenses. This ensures that even your non-tech workers have no issues, for example, viewing credited reimbursements. Even more so, training is important so that employees don’t do anything unknown with the app and generate difficult-to-spot errors.

5. Configure Transparent KPIs

Be specific about what you want the application to do. For instance, reduce approval times, decrease manual data entry, or improve adherence. Overall, KPIs help you measure how effective the tool is.

6. Test the App

Now that you have chosen the best business expense tracking app, you need to know whether it’s ideal for you or not. Take advantage of the free trial to test the tool with a few departments and teams using dummy costs. Get their feedback and gradually implement the system across your entire business.

7. Integrate

Integrations save a lot of time as they eliminate tab switching. For example, integrate your expense tracker for small businesses with your calendar app, and it will fetch expenses entered on specific dates for processing, or you can also integrate it with your payroll tool to automatically fetch any cost values required for processing.

8. Monitoring & Feedback

The next thing to do is observe how your employees are using the expense app to their benefit, and whether they are:

- Able to properly use the tool

- Just passing the time by playing around with its features.

9. Reviewing & adjusting

The software will generate detailed insights on spending habits, policy compliance, and areas for reducing expenses. Reviewing these will help you adjust the budget and have more savings for future projects.

10. Stay Updated

Business expense tracker applications continuously get improvements with better features and new upgrades to meet the ever-changing requirements. A wise idea is always to look for updates in your own field to stay ahead of the competition.

Conclusion

We hope you are now clear about the primary usage of business tracking apps and the tools we mentioned, and were able to pinpoint your ideal business expense software. As a follow-up, we would recommend never solely relying on tracking costs alone. Since time is the most irrecoverable expenditure, you should also focus on precisely and efficiently tracking the time-utilization of your workforce. This helps you reduce direct and indirect costs to increase revenue and provide better pay to employees. With that being said, integrate your expense and time trackers for maximum time and expense cost-effectiveness.

Frequently Asked Questions (FAQ)

business-expense-tracking-apps

Ans. Tracking business expenses can mean tracking, recording, and organizing the spending of your business. These expenses can be bills, fees, and other costs.

Ans. Software for tracking expenses or software solutions for tracking business expenses are apps that simplify monitoring, recording, and logging all your business expenses. What all of them do is scan your paper or digital receipts and, with their plethora of features, give you detailed reports and management capabilities regarding taxes, sales, and other expenses, helping you optimize cost management.

Ans. Yes, they can integrate with major accounting systems, apps, and tools.

Ans. When choosing the best-fit business expense tracker for your organization, you need to look for these key features.

- Income and Expense Tracking

- Receipts Organization

- Tax Organization

- Invoice and Payment Management

- Report Management

- Sales Tracking

- Vendors and Contractors Management

- Providing Secure Access

- Project and Inventory Tracking

- Analytics and Insights

- Workflow Automation

Ans. To help you quickly choose a good expense tracking software for your business, we have listed the top 10 solutions for you.

- DeskTrack

- Zoho Expense

- Rydoo

- Emburse Professional

- QuickBooks Online

- FreshBooks

- SAP Concur Expense

- Expensify

- Everlance

- Shoeboxed

- Xero

- Rippling

- Airbase

- Navan

- Webexpenses