Welcome to the commercial world, where every dollar counts. In the race for success, controlling spending becomes crucial. This is where maintaining business cost control is vital. Control of costs keeps your company viable and profitable like a financial lifeline. It entails meticulously tracking and controlling your expenditure to maximise resources, reduce waste, and increase profitability.

You may balance financial caution and development by closely examining spending, spotting chances for cost-savings, and making wise judgments. Finding methods to accomplish more with less without sacrificing quality or client pleasure is the goal. Mastering business cost control is the secret to long-term success in this hectic and cutthroat corporate climate. So let’s investigate cost containment as an art and realise its potential for business growth.

What is Business Cost Control?

Cost control meaning: Cost control is an instrument used by the management of an organization to regulate. Also, control the operation of a manufacturing concern by limiting costs within a planned level. It entails a series of activities that start with creating a budget, continue assessing employee actual performance, and conclude with implementing the necessary corrective measures if any discrepancies are discovered.

Different Types of Costs in Business

When we think about and evaluate the expenses in any business, there come many costs. All the fees which should be calculated in the industry are explained below:

- Fixed Cost – Fixed costs include rent and salary that don’t change based on output or sales volume.

- Variable Costs – Costs that vary directly about products or sales, such as raw materials or direct labor.

- Semi-Variable Costs – Fixed and variable costs, such as user fees and base rates on a phone bill, are called semi-variable costs.

- Direct Costs – Direct costs are costs like materials or labor that may be directly linked to a particular good or service.

- Indirect Costs – Costs incurred indirectly include overhead costs such as rent, utilities, and administrative wages.

- Opportunity Costs – A decision’s opportunity cost, which reflects potential gains or profits from an alternative course of action, is the cost of passing on the next best option.

Why is Cost Control Important for Businesses?

The Importance of Cost Control in Business is evident for maximizing profitability, boosting competitiveness, using resources to their full potential, guaranteeing financial stability, and assisting in formulating well-informed business decisions. It allows businesses to run effectively, change with the times, and prosper over the long haul. Here are five examples that underline its significance:

1. Maximizing Profitability

Companies may reduce costs and raise profits using effective cost control. Companies may increase their bottom line and earnings by identifying areas of wasteful expenditure, optimizing processes, and looking for ways to cut costs.

2. Increasing Competitiveness

In a market where competition is fierce, cost management provides businesses with an advantage. Companies may increase their competitiveness in the market by managing costs effectively, offering competitive pricing, upgrading the quality of their goods and services, funding research and development, and strategically allocating resources.

3. Resource Optimization

By ensuring that resources are used effectively and efficiently, Business cost control assists organizations in optimizing their use of resources. Organizations may direct their resources into tasks that provide value and spur development by identifying and removing unproductive procedures, pointless spending, and redundancies.

4. Financial Stability

Control of costs help a company maintain its financial health. Businesses may support a healthy cash flow, lower the risk of financial stress, and have the means to handle unexpected difficulties or economic downturns by control of costs.

5. Support for Decision Making

Cost control offers valuable information for wise decision-making. Businesses may make better decisions regarding pricing, investment possibilities, product development, and resource allocation. Resulting in more successful outcomes when they are thoroughly aware of their cost structure and spending habits.

What is Cost Reduction?

Business Cost reduction is lowering a business’s expenditures to increase profits. This involves identifying and eliminating expenses that don’t benefit consumers and streamlining operations to Increase Employee Productivity. It is common for cost-cutting efforts to focus on generating quick financial gains.

Difference Between Cost Control and Cost Reduction

Control of costs and Cost reduction has few significant differences; both are equally important in the growth of a business. To know both in detail few points are explained deeply:

1. Objective

Control of Costs seeks to manage and control spending within a predetermined budget or purpose. It emphasizes keeping expenses at a targeted level while preserving effectiveness and efficiency.

On the other hand, the goal of Cost Reduction is explicitly to reduce costs to reduce the entire cost structure.

2. Scope

Cost Control includes a range of tactics and procedures used to keep tabs on, evaluate, and manage expenses in many parts of the organization. It places a strong emphasis on maximizing resource use and reducing wasteful spending.

However, Cost Reduction generally focuses on identifying areas or activities where costs might be lowered. Such as renegotiating supplier contracts or locating substitute materials.

3. Long-Term vs. Short-Term

Cost Control is an ongoing process with the goal of long-term cost management. Keeping expenses in check entails continual monitoring, analysis, and modification.

Conversely, Cost Reduction frequently entails quick fixes that result in short-term cost reductions, including downsizing or launching ad hoc cost-cutting projects.

4. Impact on Operations

Cost Control maintains operational effectiveness and efficiency while balancing cost management. Costs are meant to be kept as low as possible without sacrificing quality or crucial operations.

However, Cost Reduction may include giving up certain things. Such as cutting down on investment or hiring fewer people, which might affect overall operating capacity.

5. Summarization

Whereas Cost Control specifically targets controlling costs within established boundaries, optimizing resource utilization, and preserving operational efficiency.

Cost Reduction mainly focuses on cutting expenses to create a lower total cost structure, frequently including short-term solutions.

Most Effective Cost Control Process

Ideally, the Cost control process is considered to be a continuous, cyclical process that employs the following steps:

1. Resource Planning

Put controls in place before the project begins to foresee expenses and plan resources. Review subtasks using the work breakdown structure to identify required equipment or skills. Calculate the approximate cost of the resources needed for the project using the information at hand and your current spending plan.

2. Budgeting

Distribute the funds across the project’s tasks, incorporating cost estimation and schedule. The budget is divided into separate amounts for each activity.

3. Cost Management

Throughout the project, protect and manage the budget. When comparing accurate prices to the baseline cost, take appropriate action. Review the results of the activities, then make any necessary revisions.

Top 5 Ways to Reduce Costs in a Business

The paragraphs below cover the top 5 ways to reduce costs in a business to mitigate and manage a business’s costs separately.

1. Process Optimization

Feel motivated and productive as you examine workflows and spot inefficiencies. Simplify processes to save expenses and remove waste so that you may produce the most with the fewest resources possible.

2. Supplier Negotiation

Use your cunning and boldness to seek discounts, bulk purchasing opportunities, and long-term contracts with suppliers to save money on procurement.

3. Outsourcing

Utilize outsourcing to reduce administrative expenses and get access to specialized service providers’ knowledge. Economies of scale while embracing a feeling of strategic decision-making and efficiency.

4. Automation and Technology

As you implement automation and cost-effective technologies that simplify operations, eliminate human labor, and minimize mistakes. Resulting in higher efficiency and lower operating costs, you can feel inspired about progress and innovation.

5. Inventory Management

Applying efficient inventory management techniques, you should minimize surplus inventory, improve demand forecasting, and lower storage and carrying expenses.

Top 5 Cost Control Techniques for Your Business:

A few Business Cost Control Methods are stated below:

1. Budgeting and Planning

As you construct thorough budgets and strategic plans, define financial objectives, and intelligently allocate resources. See a route to success while maintaining cost management, you’ll feel in charge and organized.

2. Expense Tracking and Monitoring

Develop awareness and accountability as you constantly track and analyze expenses, find pockets of overspending or inefficiency and make wise choices to manage costs efficiently.

3. Cost-Conscious Culture

Encourage staff to be cost-conscious and actively contribute suggestions for cost management, establishing a group effort towards reaching financial goals. This will develop a sense of cooperation and dedication.

4. Performance Measurement and Analysis

Be tenacious and wise as you track cost-related metrics. Measure and analyze key performance indicators. Pinpoint potential for cost savings.

5. Continuous Evaluation and Adaptation

Adopt a constant improvement and adaptation mentality as you periodically review and enhance your cost-control techniques. Solicit stakeholder input. Make necessary adjustments to guarantee their efficacy and relevance.

Top 4 Cost Control Tools in the Market

As we know, cost control plays a vital role in the progress of a business. So here are the top 4 cost control software in the market to analyze and control the cost:

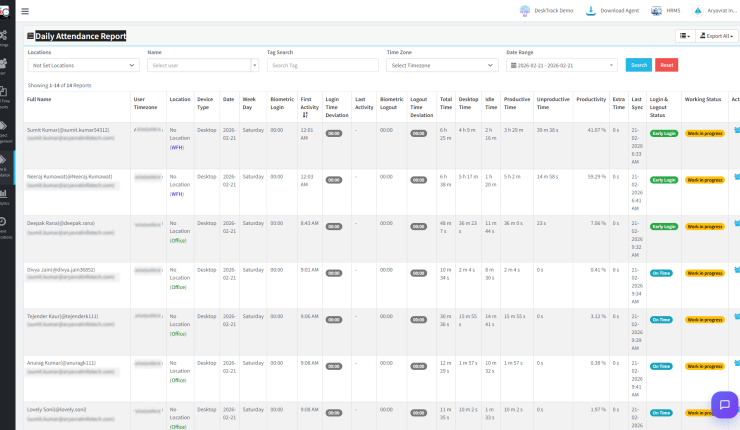

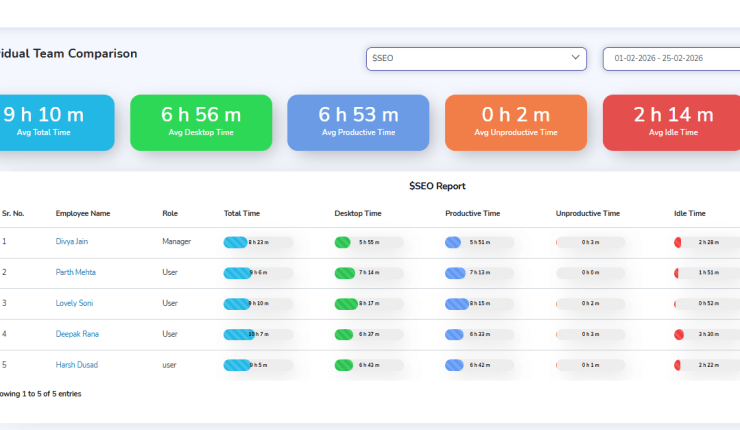

1. DeskTrack

DeskTrack boosts productivity and cost-effectiveness with Employee Productivity Monitoring Software. Apart from these here are some more Key points why one should use DeskTrack for cost control.

- Productivity: Boost worker output by accurately tracking and logging their time.

- Cost-Effectiveness: Increase cost-effectiveness by wisely allocating resources under information on time utilization.

- Project Management: To better allocate resources, measure and analyze how much time is spent working by employees.

- Cost Management: Business Cost control measures may be improved by keeping an eye on and controlling Time Tracking related costs.

2. Cost Projection

As Cost Projection Gain peace of mind with precise cost-estimating tools for informed financial decisions. Apart from these here are some more Key points why one should use Cost projection for cost control.

- Making Well-Informed Judgments: Making well-informed judgments based on accurate expense estimates is essential for successful financial planning.

- Managing Expenditures: Control of costs successfully requires depending on accurate cost-estimating tools.

- Economic Success: Accurate cost projections provide the foundation for financial success.

- Financial Peace of Mind: Accurate expense estimates might provide you comfort when you’re doing your financial planning.

3. Budget

As Budget, a cost control software, take control of your financial future and prioritize expenses with strategic budgeting tools. Apart from these here are some more Key points why one should use Budget for cost control.

- Adherence to Expenditure Caps: Keep an eye on how closely set spending limits are followed to maintain financial restraint.

- Accuracy of Expense Tracking: Measure expense tracking and recording accuracy to assess the dependability of budgeting tools.

- Achieving the Cost Control Objective: Analyse how cost management objectives are fulfilled through efficient budgeting and prioritization.

4. Cost Tracking

As Cost Tracking Software, Stay vigilant and proactive in managing expenditures with real-time data and analysis. So it’s a good software to control cost. Apart from these few key points are given below.

- Analysis of Data: Ascertain the degree of insight into expenditure using real-time data and analysis.

- Maintaining Efficiency: Boost productivity by monitoring your ability to identify expenses and take corrective action to prevent them.

Conclusion

For a corporation to be successful, profitable, and financially stable, cost control is crucial. Cost control meaning is, By putting into practice efficient cost management tactics like process optimisation and supplier negotiation, firms may make educated decisions and cultivate a culture of cost consciousness. By continuously evaluating and adapting Business Cost Control techniques and utilizing tools like cost estimating and monitoring solutions, companies can optimize resource utilization and adjust to changes. Embracing cost control as an art evokes determination, resourcefulness, and a sense of control, enabling long-term success and growth.