Are you looking for the best payroll software in India? Then you are in the right place. Due to the simple working environments and less hustle and bustle, calculating salaries and other employee incentives was also easy. However, using payroll tools is the need of the hour in today’s advanced and fast-paced era. In today’s post, we will run you through the A to Z on the 10 best payroll tools. We will also help you choose the best-fit payroll software solution for your business. So, let’s dive right into it.

An Overview of Payroll Management Software

In short, payroll management software is a tool package that simplifies payroll and, at times, other HR processes. These are either integrated systems with other software or are individual feature bundles. Furthermore, you can also combine these with other tools, such as time tracking software. Based on this, the web-based payroll software provides some practically useful features, such as:

- Salary Calculation: The tool automates salary calculations, such as gross pay, net pay, etc, streamlining workflows and saving time.

- Compliance Management: The software automates and simplifies compliance handling by staying updated with guidelines, such as GDPR, HIPAA, etc.

- Payroll Processing: Payroll processing automation is the primary function of the tool. This means that the tool just needs you to feed salary rates and work hours, and it will accurately process the rest on its own.

- Payslip & Report Generation: Implementing software for payroll in your organization also accrues payslip and report generation. This is due to precision in payroll processing.

- HRMS Integration: The top payroll software can also seamlessly integrate with your HRMS system, interconnecting and aligning all your HR processes.

- Employee Self-Service: The platform also provides a self-service portal where employees can check their leave balances, reimbursement status, salary dues, and other general information, saving the time of your HR professionals for the work that matters.

- Flexibility & Scalability: The best tools for payroll automation are flexible and scalable to adapt to your growing business needs with add-ons.

- Analytics & Reporting: These are dashboards that provide information, such as tax, salaries, and deductions, at a glance. You also have the option to view detailed or summarized reports.

- Data Privacy & Security: The best tools for payroll automation also keep crucial salary data safe from insider threats and viruses.

- Mobile Accessibility: This feature provides you with the flexibility to access payroll data and process payments anytime and anywhere.

- Support & Customization: Only the payroll tools with a high level of support and customization are easy and less time-consuming to implement.

Read Also: Leader vs Boss – Key Differences & Why It Matters

Benefits of Using Web-Based Payroll Software

Make your workday more productive

Time tracking and work management can help you reach your goals

faster.

Other than accruing payroll processing and payslip generation, there are many other benefits of implementing payroll software in India and Indian businesses. Here are a few that we have experienced.

1. Error-Free and Accurate

Using a payroll management system for calculating salaries and incentives reduces or even eliminates errors. Plus, it is highly accurate and efficient when it comes to calculating payroll, billing, and invoicing.

2. Seamless Integrations

What we like about the best payroll software in India is that it can be integrated with other tools you use. This provides more accuracy, efficiency, and smoother processing. For example, integrating with time tracking software lets you directly send work-hour data to the payroll tool for faster processing.

3. Save Time and Costs

Since it’s error-free and accurate, using the best payroll software for your business not only saves you time. However, it also saves you expenses. Since you don’t have to double-check or recalculate payroll values, you can think of this software solution as a handy assistant.

4. Security

Sensitive and essential employee information needs to be kept safe. The best payroll software in India does just that. It not only accurately and efficiently processes payroll, but it also provides the latest data security measures for essential information.

5. Compliance

Using software for payroll management also ensures that you stay updated with the latest labor laws, salary, and wage rules. The software provides automated updates to comply with the rules and regulations so that you don’t have to face any legal issues.

The Importance of Payroll Software in India

Let us be honest here. In India, payroll goes beyond distributing the right amount of wages or salaries to employees. Businesses must strictly comply with labor laws and other guidelines. A slight error and you can face large penalties. Plus, don’t forget about employee disputes, turnover, and dissatisfaction. On the other hand, implementing the right online payroll software in India ensures:

- Accuracy: There is no human error due to payroll automation.

- Time Savings: As we mentioned before, payroll automation saves you a lot of time for crucial work that matters.

- Compliance Confidence: As we mentioned before, the right tool for payroll automation takes care of the compliance management as well, so that you can focus on other important things.

- Worker Satisfaction: Payroll accuracy ensures timely salary disbursements and distributions, ensuring higher employee satisfaction.

How to Choose the Best Payroll Software in India in 2025?

So above, we discussed what it is and the benefits of using the best payroll software in India. However, how will you know if the chosen payroll software is the best-fit solution for your business? Thanks to the many payroll processing tools in the market, shortlisting and finalizing your payroll options can be overwhelming. Not to worry, as we have got you covered here as well.

1. Requirement Analysis

The first step to choosing one tool from the payroll software list is evaluating your requirements. Here, we recommend making a structured analysis report that provides you with insightful details. This gives you the groundwork for researching and shortlisting the top payroll software.

2. Adherence Management Assurance

As we mentioned before, the best payroll software in India ensures compliance with labor and wage laws. So checking for the level of this feature is also essential.

3. Check Essential Features

When it comes to choosing the best payroll software for your business, it is crucial to check for the prominence of all the features you need. Here, we recommend choosing quality over quantity.

4. Get a Free Demo

This is the era of try before you buy. This phenomenon applies to everything, including choosing the best payroll software in India. In this context, payroll processing apps provide free demos and trials. So, overall, you can be sure even before buying whether the tool is right for you.

5. Cost vs. Budget Analysis

You don’t want to go bankrupt after buying software with the best payroll services. Do you? That’s why this is also an important step. Generally, you can check for this information on the software’s website. However, we recommend being double-sure by browsing other resources as well.

6. Read Reviews

What can be a better way to finalize the best payroll software in India for your business than asking those who are already using it? Reading genuine reviews is the best way to know if the payroll software is what it claims to be.

10 Best Payroll Software in India for 2025

With so many payroll processing software in the industry, finalizing the best one can be overwhelming. Plus, staying away from fakes and scams is also crucial. So, to help you get a head start in finalizing the best payroll software for your business, we are giving you a detailed list below. In this list, you will also find the reason to choose a particular payroll software, its initial pricing, and genuine user ratings.

- DeskTrack

- Craze

- factoHR

- HROne

- Zoho Payroll

- Razorpay X Payroll

- HRMantra

- greytHR

- Pocket HRMS

- sumHR

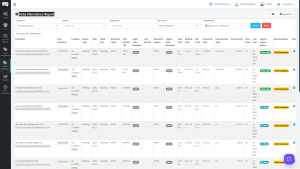

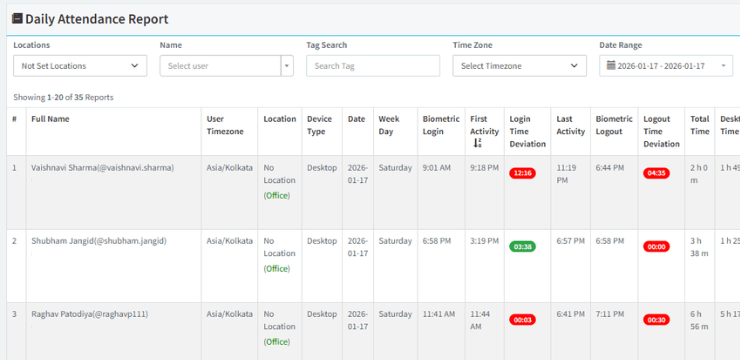

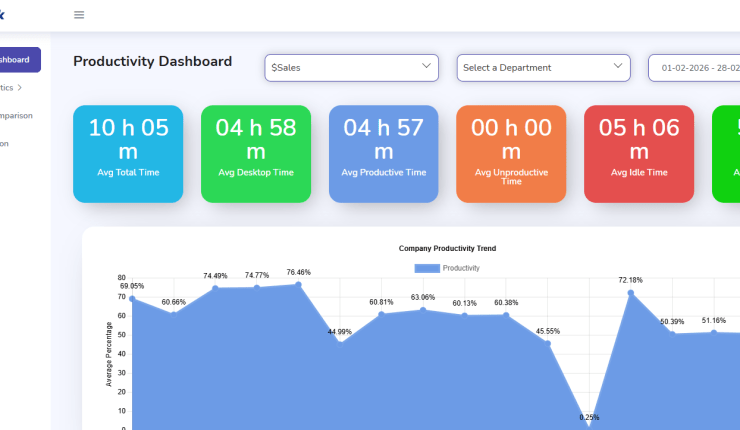

1. DeskTrack

DeskTrack is hands down the best payroll management software in India on our list. More than an integrated payroll software, it is the top customizable employee monitoring, project management, time tracking, and productivity monitoring tool with intuitive features to simplify monitoring your in-office, remote, and on-field employees.

Key Features:

| Why Choose | Most Affordable Paid Plan | User Rating |

| Best overall | $5.99/user/month | 5/5 |

2. Craze

Craze is a good payroll management software on our list. It’s an all-in-one HR, payroll, and compliance management application we recommend for startups. Craze provides an integrated system that simplifies all your administrative work from onboarding to offboarding. What we like about this tool is the one-click payroll feature.

Key Features:

- Payroll reports

- Benefits administration

- Self-service dashboard

| Why Choose | Most Affordable Paid Plan | User Rating |

| All-in-one HR, payroll, and compliance | $0.68/user/month | 4.1/5 |

3. factoHR

Next up, we have factoHR. It is one of the best payroll software in India that comes with an all-in-one HR and payroll management package. It’s a fully secure and integrated system with all the internal and external modules you require. What we like about this software is the plug-and-play integration with the validation engine that minimizes human intervention.

Key Features:

- Centralized payroll data

- Statutory and compliance management

- Arrears and salary revisions management

| Why Choose | Most Affordable Paid Plan | User Rating |

| All-in-one HR and payroll management | $56.28/month | 4/5 |

4. HROne

HROne is a payroll management system compatible with more than 15 ERP software solutions. It’s an easy-to-configure HR and payroll management tool on our list, making it a great choice for organizations. What we like about it is that it automatically synchronizes databases to allow seamless data flow between financial systems. Plus, the automation also saves time.

Key Features:

- Payout insights

- Employee self-service portal

- Salary verification management

| Why Choose | Most Affordable Paid Plan | User Rating |

| Easy-to-configure HR and payroll management software | $55.73/month | 4.3/5 |

Read Also: 11 Proven Strategies for Meeting Deadlines in the Workplace

5. Zoho Payroll

Zoho Payroll is one of the best payroll software in India. Especially if you want a tool for instant salary disbursements. It provides a simple and scalable payroll processing system with the capability to make multiple pay slabs for different hierarchies of employees. What we like about it is the feature that allows seamless compliance as it considers components, including ESI, PF, IT, PT, and LWF.

Key Features:

- Personalize salary components

- Online salary delivery

- Multi-level approvals for payroll security

| Why Choose | Most Affordable Paid Plan | User Rating |

| Instant salary disbursements | $11.26/organization/month | 3.9/5 |

6. Razorpay X Payroll

For completely automated payroll and compliance, we recommend Razorpay X Payroll. This software for payroll management provides features for accurate salary calculations and direct bank account deposits. What we like about this software is the leave management system. Plus, the capability to revise salaries at any point in time is also useful.

Key Features:

- Dashboards

- Payslip management

- Compliance management

| Why Choose | Most Affordable Paid Plan | User Rating |

| Completely automated payroll and compliance | 2% transaction fee/ transaction + 18% GST | 4.3/5 |

7. HRMantra

HRMantra is yet again one of the best payroll software in India. It’s an integrated hire-to-retire web application that many organizations prefer. The best part about this one is the capability to process payroll and FFS processing for your worldwide branches from a single platform. What we like about this tool is that it makes introducing and deducting various taxes simple.

Key Features:

- Attendance management

- Performance management

- Leave management

| Why Choose | Most Affordable Paid Plan | User Rating |

| Best for multinational businesses | Quote on contact | 4.1/5 |

8. greytHR

greytHR is another good software on our payroll software list. It provides intuitive features, including automated policy reinforcements and online claim submissions. Overall, it reduces up to 80% of your administrative burden. Furthermore, the unlimited salary components and customizable salary structures make it a good choice for numerous industries.

Key Features:

- Payroll processing management

- Statutory compliance management

- Direct debit for payouts

| Why Choose | Most Affordable Paid Plan | User Rating |

| Reduces up to 80% of administration work | $39.35/month | 4.3/5 |

9. Pocket HRMS

Pocket HRMS is yet again one of the best payroll software in India and a complete HR Management Software for enhancing payroll flexibility. What we like about this tool is the single-employee and multi-category payroll processing options for maximizing payroll efficiency. Plus, you can easily make payroll rules for multiple employee categories based on your organizational hierarchy.

Key Features:

- ML-based payroll processing

- Advanced pre-process checks

- Multiple salary structure-support

| Why Choose | Most Affordable Paid Plan | User Rating |

| Enhances payroll flexibility | $0.68/user/month | 4/5 |

10. sumHR

If you want the best payroll software for your business for complete salary disbursements. That too, with just 5 simple steps, then we recommend sumHR. What you get for an affordable monthly fee is automated operations, including payroll calculation, TDS, PF deductions, tax exemption calculation, and gratuities.

Key Features:

- IT declarations

- Payroll outsourcing

- Payroll outsourcing

| Why Choose | Most Affordable Paid Plan | User Rating |

| Complete salary disbursements | $0.55/user/month | 3.8/5 |

Why is DeskTrack the Best Choice for Payroll Management in 2025?

DeskTrack is more than the top HR payroll software in India. It’s the best employee monitoring software that combines the latest and most intuitive project management, productivity tracking, and time tracking features. Plus, seamless integrations and a high level of customization are what make it stand out.

However, why is it your top choice for payroll management? Let’s see below to find out why multiple users and companies across 100+ countries use it for payroll processing.

- Automated timesheets and task timers improve focus and efficiency. Furthermore, the capability to send work-hour data directly to payroll enhances accuracy.

- The capability to automatically calculate billable and non-billable hours ensures invoicing accuracy.

- You get the best measures for securing essential employee data.

- You get the best features to track employee hours.

Frequently Asked Questions (FAQ)

Q. What is Payroll Management Software?

Ans. In short, payroll management software solutions are tool packages with features to accrue and automate payroll processing. These are either integrated systems with other software or are individual feature bundles. The idea behind using the software is to reduce the administrative burden and save the expenses and time of your organization.

Q. How to Select the Best Payroll Software in India?

Ans. With so many payroll software options in the industry, choosing the best payroll software in India can be overwhelming. Plus, you also need to be wary of fakes and scams. With that, here is the step-by-step process for the same.

- Requirement Analysis

- Adherence Management Assurance

- Check Essential Features

- Get a Free Demo

- Cost vs. Budget Analysis

- Read Reviews

Q. What are the Benefits of Using a Payroll Management System?

Ans. Using a payroll management system not only provides features for payroll processing automation. However, you also get these other advantages.

- Error-Free and Accurate

- Seamless Integrations

- Save Time and Costs

- Security

- Compliance

Q. Which are the Best Payroll Software Solutions in India?

Ans. Payroll maintenance and processing software are tool packages that provide features to accrue and automate payroll processing. There are also various other benefits, including enhanced compliance. With that, here are the 10 best payroll software in India.

- DeskTrack

- Craze

- factoHR

- HROne

- Zoho Payroll

- Razorpay X Payroll

- HRMantra

- greytHR

- Pocket HRMS

- sumHR