Are you pulling your hair calculating payroll hours and employee time? Do you want to save the complex payroll calculation time and focus on other crucial tasks? Lastly, do you want to calculate payroll like a boss smartly? Then you are not alone. Around 30% of businesses claim their payroll accuracy to be below 90%. To us, this is alarming.

As per a survey, around 57% of businesses in India alone still rely on pen and paper for payroll processing and management. Manual payroll is simple and affordable. Especially for small businesses. However, on the downside, it is prone to mistakes. Plus, don’t forget that calculating payroll times this way is time-consuming.

So, in this blog, we will try to wrap our heads around properly calculating payroll hours. By the end of this post, you will have your perfect solution to error-free payrolls, which in turn results in satisfied employees. With that being said, let’s dive right in.

What are Payroll Hours?

Before efficiently computing hours worked (regular and overtime), you must know what they are. Simply put, payroll time is the total payable hours, that non-salaried employees get within a pay period. Usually, it is weekly, monthly, or yearly. Typically, there is a set hourly pay rate for non-salaried employees. So, calculating their payable hours is crucial. Failing to do so accurately results in:

- Employee payment disputes.

- The risk of lawsuits against your organization.

- Penalties for not complying with labor laws.

As per an IRS (Internal Review Service) report, it was revealed that 33% of businesses make annual payroll errors. In short, billions of dollars go to waste each year. However, you won’t have to face such a huge loss, because we have covered every crucial detail around the payroll process.

Read Also: Work Schedule Apps for Business: A Complete Guide

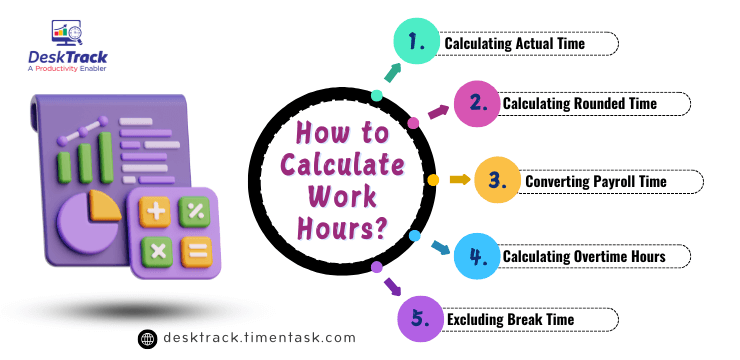

How to Calculate Work Hours?

Now that you have a clear idea, we can start calculating payroll hours. This section covers everything in detailed insights. However, we guarantee that you won’t face any complexities in computing salaries after today. With that being said, let’s get started right away.

1. Calculating Actual Time

Your first option is to calculate salaries and invoices based on the actual total time your employees worked. However, for that to be simple, your time tracking software must provide you with accurate values. Here’s how it works.

- Add the complete hours including 5 days X 8 hours = 40 hours/week.

- The next step is to add the minutes. For example, 13 + 7 + 4 + 9 + 2 = 35 minutes

- The total would be 40 hours and 35 minutes.

In our example, the time is correct. However, we can’t use it for calculating the time for payroll since it’s not in decimal format.

2. Calculating Rounded Time

Another method for calculating payroll hours is the rounded time method. Now, it is a complex one. Remember that this practice is legal but you must follow strict rules for applying it. Such as:

- You can round to only 15-minute intervals.

- You can only use the following minutes after an hour

- :00

- :15

- :30

- :45

- If an employee clocks in or out at any time other than the 15-minute blocks, then you must round it to the nearest up or down minute.

Clear so far? Yes, good. Because this is where it gets more complex. To calculate hours for payroll this way, you must also follow the 7-minute rule. Simply put, you round down if the logged time is within 7 minutes. Otherwise, you round up. For example, 9:07 AM becomes 9:00 AM and 9:08 AM becomes 9:15 AM.

- After rounding up or down, you subtract clock in time – clock out time to get the total hours worked for the day.

- For example, your employee clocked in at 9:08 AM (9:15 rounded) and clocked out at 5:28 PM (5:30 rounded).

- The first step now is to convert all hours to the 24-hour format. So 5:30 PM becomes 17:30.

- The next step is 17:30 – 9:15 = 8:15, which means that your employee worked hard for 8 hours and 15 minutes. However, before you can calculate pay, you still need to convert this to decimal format.

For calculating payroll hours this way, you can also use the 5 or 6-minute rounding method. However, remember that:

- It should never harm your employees’ interests.

- If you fail to fairly pay your employees, it can result in wage theft accusations and trials.

- You must set up rounding in your employees’ favor only. You must never round work hours in your interest as it’s illegal.

Sneak Peek: Like everything else, there’s a workaround for this method for calculating payroll times as well. What you can do is round the clock in time in the employee’s favor and the clock out time in yours.

3. Converting Payroll Time

The next step involves converting payroll time into the decimal format. The reason for doing so is because whether you use the actual time or rounding method, you will get the work hours in hours and minutes. This time when multiplied by the hourly wage returns incorrect salaries.

So, to convert this time into the decimal format for calculating payroll hours cost, you will divide the minutes by 60. For example, if your employee worked 8:20 hours, you will divide 20/60 to get 0.33. So the total hours here is 8:33. However, why go through all this trouble when we have got this conversion chart for you?

Sneak Peek: You will only need this table for reference as there are many free decimal time hour calculator converters for payroll available online.

4. Calculating Overtime Hours

When calculating payroll hours, taking overtime into account is also mandatory. Simply put, even a minute your employee has worked over 40 hours is overtime in the USA. These are paid 1.5 times higher than regular hours and are also known as “time-and-a-half.” It is essential for you to accurately track overtime for:

- Accurate payrolls to pay the correct amount to your employees.

- Maintain compliance with labor laws.

5. Excluding Break Time

Calculating the time for payroll also includes excluding any breaks and time off from the week. Typically for rest, it’s 5-20 minutes. For meals and lunch, it’s around 30-40 minutes. Another thing to remember is it’s up to you to whether pay your employees for lunch time or not. However, an ethical practice is to pay employees including this time as well. Especially, if they worked in these hours.

Read Also: Best 5 Ways to Calculate Employee Productivity in 2025

How to Track Employee Hours?

Another important thing to consider when calculating payroll hours is how you track the work time. There are a few common methods with businesses and organizations worldwide use for the same.

1. Registers and Time Cards

This is the old and outdated method. So, we can’t help but wonder why businesses still use it to calculate hours for payroll. What happens here is employees document their work hours on paper time cards or registers. Moreover, there are many issues with this method.

- Employees can submit false hours or overtime.

- Computing payroll from this data is:

- Time-consuming

- Inaccurate or prone to errors

- Inefficient

- Every employee has a different handwriting. Reading and processing all of them can be a headache.

2. Mechanical Time Clocks

This is a slightly sensible method for calculating payroll hours by clocking in and out. What employees do is insert a time card into a reader, which records the date and time. Your HRs can calculate the total hours worked from this information.

3. Electronic Time Clocks

Similar to the mechanical clock for computing payroll times, the electronic clock follows the same principle but is paperless. So it saves trees. Nevertheless, here’s how it works:

- Your employees present a badge in front of the device.

- It reads the date, start time, and end time.

- Some electronic time clocks work with a fingerprint or PIN.

4. Time Clock Software

The time clock software for clocking in and out is so far the best method on our list. Employees can record their time on a computer or mobile device. Plus, it’s completely digital and at times automated or single-click enabled.

Furthermore, some software solutions are also location-enabled to allow employees to mark their attendance at work. What we like about it is that it automatically calculates the work-time/pay period for calculating payroll hours.

5. Time Tracking Software

The most accurate way of computing hours worked is using time-tracking software. Using such tools gives many advantages including:

- Automated timesheets and task timers.

- Automated idle hours calculation. So that you don’t have to manually exclude break time.

- Flexible pause, resume, and stop timers for the most accuracy in work-hour calculation.

- Integration with attendance and payroll software for streamlining the payroll process.

- Calculating time deviations between system login/logout and clock in/out.

Calculating Payroll Hours in a Nutshell: Step-by-Step Process

In case you missed it for the first time, here is the process of calculating payroll hours again. However, in short. This section covers a summary of the process with some examples for better understanding. So, let’s take a look.

1. Step 1: Convert to 24 Hours

The first step for calculating the time for payroll is simple. All you have to do is convert the hours into military time. That is the 24-hour format. For example:

- 8:28 AM = 8:28

- 5:35 PM = 5:35 + 12 = 17:35 (add 12 to the afternoon hours)

2. Step 2: Calculate Total Hours

The next part for calculating payroll hours is computing the total workday time. All you have to do is subtract the clock in time from the clock out time. However, if the end hour is greater than the start hour, you will have to borrow 60 from it for simpler calculations. For example:

| No Math Borrowing | Math Borrowing |

| 15:45 (3:45 PM) – 8:30 = 7:15, which is 7 hours and 15 minutes | 15:13 – 8:45 becomes 14:73 – 8:45 = 6:28, which is 6 hours and 28 minutes |

3. Step 3: Exclude Unpaid Hours

Halfway down our process to calculate hours for payroll, we consider the unpaid hours, which are the lunch-time and/or break times. Here’s the formula:

- Total time – lunch break time = working time

- For example, 9:07 – 1:00 = 8:07

4. Step 4: Calculate Total Hours for the Month

The next step for calculating payroll hours is to get the total work-time for the month. All you have to do is add all the total weekly hours of the past month to get this value.

- For example, 15:36 + 39:16 + 40:45 + 41:01 + + 41:30 = 178:08, which is 7 days and 10 hours.

5. Step 5: Calculate Minimum Working Hours

The next step to calculate payroll times is to derive the minimum monthly working hours. Here’s the formula.

- Working days in the month X required working hours/day.

- For instance, 22 days X 8 hours = 176 hours.

6. Step 6: Calculate Overtime Hours

Finally, for calculating payroll hours, you will compute overtime hours. Here’s how to do it.

- Total working time – minimum working hours.

- For example, 178:08 – 176:00 = 2:08, which is 2 hours and 8 minutes.

How to Calculate Time Worked in Hours Cost Per Employee?

Now that we have the payroll times in decimal format, we can now calculate the salaries. Here’s the formula.

- Hours in decimal X hourly pay rate = total pay (before deductions)

- For example, the rate is $20/hour and the weekly total is 38.2 hours. Total weekly salary (before deductions) for one employee = $20 X 38.2 = $764.

Read Also: How Much Costing of Employee Monitoring Software per User

DeskTrack Accrues Payroll Calculation

So far so good. We tried to simplify all about calculating payroll hours. However, what if we don’t even have to go through this much trouble?

With DeskTrack, all the payroll calculations are simplified with seamless integrations, automated attendance tracking, and AI automation. We have been using this all-in-one employee monitoring software for years now and it has:

- Lifted the burden of manually doing every minor task off our HR department’s shoulders.

- Increased employee satisfaction.

- Accrued payroll and invoicing.

- Increased the efficiency and productivity of our employees.

Conclusion

Hope that now you are clear about calculating payroll hours. As a final word, we would like to say that accurate payroll calculation can be a painstakingly hard job unless you know the smart way to do it. Inaccuracies here can cause wage theft accusations, trials, employee payment disputes, and penalties, and your organization can end up facing a lawsuit for not complying with labor laws. In short, if you don’t want to end up in jail, your payroll processing must be perfect. Here, you can use the actual time calculation or round-off as you account for overtime while excluding breaks and time off. Typically, you will get the work hours data from one of the methods, which you may use including registers and time cards, mechanical time clocks, electronic time clocks, and time clock software. However, why go through trouble when you can use the time tracking tool DeskTrack?

Frequently Asked Questions (FAQ)

Q. What are Payroll Hours?

Ans. Simply put, payroll time is the total payable hours, that non-salaried employees get within a pay period. Usually, it is weekly, monthly, or yearly.

Q. What is 45 Minutes in Decimal Time?

Ans. To convert minutes to decimal, you have to divide minutes by 60. Thus 45 minutes in decimal time is 0.75. Similarly, here are a few more instances.

- 20 minutes = 0.33

- 25 minutes = 0.42

- 30 minutes = 0.50

- 35 minutes = 0.58

- 40 minutes = 0.67

Q. How Do You Calculate Hours Worked for Payroll?

Ans. To calculate hours worked for payroll, you need to follow these few steps.

- Convert to 24 Hours

- Calculate Total Hours

- Exclude Unpaid Hours

- Calculate the Total Hours for the Month

- Calculate Minimum Working Hours

- Calculate Overtime Hours

- Convert the Time to Decimal Format for Accurate Salary Calculation.

Q. What is the Formula for Computing Payroll?

Ans. There are 2 formulas for deriving payroll hours respectively for gross pay and net pay.

- Gross Payment = Hours Worked X Hourly Pay Rate

- Net Payment = Gross Payment – Total Deductions