Time clock rounding is perhaps one of the most basic ways to simplify payroll and boost employee satisfaction and morale. However, you still need to do it legally and properly to avoid any issues. You see when it comes to payroll, the most essential things are accuracy and efficiency to fairly compensate your employees and retain them in your organization.

Did you know that every payroll mistake can cost your business $291 on average? It means that if you regularly deal with these mistakes, you can lose 1000s of dollars each year just like that. The reason for this is that computing payroll is complex. That’s why to simplify the calculations, you need to use one of the rounding-the-clock methods.

So in this complete guide to time clock rounding, we will try to provide you with the most useful insights, which you can use to accrue payroll right away. With that out of the way, let’s get started.

What is Time Clock Rounding?

Simply put, rounding clock time means to round the clock in and clock out minutes up or down. Remember that it is a way of simplifying and standardizing timekeeping procedures and in no way intended to steal employee work hours. It involves:

- Rounding off the time an employee clocks on and off to a specific increment or decrement in minutes.

- For instance, if an employee clocks in at 8:53 AM and you are using the 15-minute rounding rule, their start time would be 9:00 AM.

This way, time clock rounding provides many benefits essential for accurate payroll. For example.

- It simplifies work-hour calculations, which simplifies time tracking and management for employees and employers.

- It reduces payroll and employee attendance tracking complexity, assuring employees of fair salary payment.

Read Also: Calculating Payroll Hours: The Complete Guide

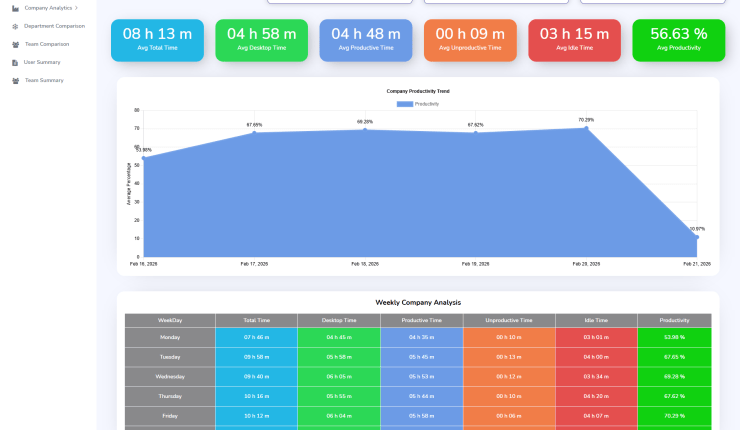

5 Reasons Why Time Clock Rounding is Essential

So far we know a few benefits of rounding payroll hours. However, it’s not just limited to that. Per our expertise and experience, this aspect has 5 more major benefits.

1. Payroll Calculations

Tiny parts of the clocked hours of your employees including a few minutes or hours can become a challenge when computing payroll. What it does is increase the chances of errors. On the other hand time clock rounding simplifies these calculations by rounding off minutes to simple increments of 5, 6, or 15.

2. Calculating Billable Hours

Another aspect where you need to carefully consider time clock times is billable hours. It is essential to accurately bill your clients for the hours worked. Thus, time rounding is beneficial here. Plus, it’s not practical as well to send an invoice of let’s say 10 hours and 3 minutes.

3. Early Clock In/Out

Rounding work hours also prevent employees from clocking in/Out before their schedule. In cases, where the workplace is at a different location and the attendance machine somewhere else, employees can clock on early and then spend time chit-chatting before heading to their destined workstations. Well, not anymore.

4. Reduces Labor Costs

Rounding the clock also helps employers avoid paying employees for the work that was not performed. For example, if an employee punches in late and punches out early, you can round up the difference in their timesheet.

5. Provides Flexibility

It is a time clock rounding benefit for employees. It means that they can clock in late and leave early and still get paid for the missed hours. However, this should be applied in only extreme emergency cases such as accidents.

Essential Time Clock Rounding Legal Rules

Rounding clock time is legal for businesses. However, if you don’t follow the proper rules, it can quickly become employee work hours stealing, which you don’t want. These must-follow regulations are set by the Department of Labor. To abide by them, you must keep these points in mind.

- The maximum rounding time is 15 minutes. You can never round up or down to let’s say 30/60 minutes.

- It must always be favorable to your employees or simply put impartial or never in the employer’s complete favor.

- Rounding in your favor means that the employee loses payment, for which they can file a wage and hour grievance complaint.

- What you can do to ensure fairness is:

- Round the clock in and clock out time in your employees’ favor.

- Round the punch in time in your employees’ favor while the out time in your favor.

Read Also: Compliance Management System Software: A Complete Guide

3 Time Clock Rounding Rules You Must Know

If you are using time clock rounding for payroll simplification, then you need to also know the 3 ways you can do it. Each of the methods has slightly different rules and differs in the round up or down outputs.

1. 15-Minute Rounding

This is the most commonly used method of rounding payroll hours, which organizations use worldwide. Here’s how it works.

- You need to use the 7-minute clock rule, which determines whether you will round up or down.

- For clocked times below the 7-minute mark, you will round down. Otherwise, you will round up.

Below, we have provided a reference chart for the 15-minute time clock rounding technique.

| Minutes After an Hour | Rounded To |

| :00 to :07 | :00 |

| :08 to :22 | :15 |

| :23 to :37 | :30 |

| :38 to :52 | :45 |

| :53 to :59 | :00 (of the next hour) |

2. 6-Minute Rounding

Another method of rounding the clocking time is to round up or down to a tenth of an hour. It is also known as the 6-minute rule. For example, if your employee punches in at 9:04 AM, it becomes 9:06 AM. Confusing? Here’s a reference chart.

| Minutes to an Exact Hour | Round To | Tenth of an Hour |

| :58 to :03 | :00 | 0 |

| :04 to :09 | :06 | 0.1 |

| :10 to :15 | :12 | 0.2 |

| :16 to :21 | :18 | 0.3 |

| :22 to :27 | :24 | 0.4 |

| :28 to :33 | :30 | 0.5 |

| :34 to :39 | :36 | 0.6 |

| :40 to :45 | :42 | 0.7 |

| :46 to :51 | :48 | 0.8 |

| :52 to :57 | :52 | 0.9 |

3. 5-Minute Rounding

If the 15 and 6-minute rounding methods are too complex for you, there is also this 5-minute time clock rounding technique. This simple technique is based on the two-and-a-half-minute split of each increment. For instance:

- A clocking time of 9:02 becomes 9:00.

- A punching time of 9:03 goes up to 9:05.

Here’s a simple conversion table for the time clock times for this method.

| Minutes to an Exact Hour | Round To |

| :58 to :02 | :00 |

| :03 to :07 | :05 |

| :08 to :12 | :10 |

| :13 to :17 | :15 |

| :18 to :22 | :20 |

| :23 to :27 | :25 |

| :28 to :32 | :30 |

| :33 to :37 | :35 |

| :38 to :42 | :40 |

| :43 to :47 | :45 |

| :48 to :52 | :50 |

| :53 to :57 | :55 |

Read Also: Best 5 Ways to Calculate Employee Productivity in 2024-25

5 Challenges of Time Clock Rounding

So far, so good, we have discovered the benefits and methods of time clock rounding. However, like everything else, it also has a few limitations, which you need to consider. Otherwise, you will have some serious issues to handle.

1. Off the Clock Working

Also known as unpaid working or in simple terms, employee hours stealing is a violation for which you will have to pay a hefty fine. For example, due to rounding the clock if an employee’s clock in time of 8:55 becomes 9:00, they worked 5 minutes for free, which becomes 25 minutes for the week if done daily.

2. Inaccurate Timesheets

Time clock rounding if done excessively can result in inaccurate timesheets. Employees are allowed to and will claim unfair or illegal reduction of wages, for which you will have to face the law.

3. Payroll Disputes

Rounding clock times to extreme levels can lead to payroll discrepancies. In other words, an employee may be paid less than they expect. A workaround for this is to explain your work-hour rounding policies to your employees.

4. Employee Micromanagement

For some employees time clock rounding can translate to micromanagement. The results of this can be reduced employee morale and trust. Overall, it can lead to more employee turnover and reduced productivity levels.

5. Rule-Extensive

Another issue with work hours rounding is that it’s rule-extensive. If you make one misstep, you can face multiple lawsuits. Plus, a mistake here can also mess up the next step before calculating employee pay, which is the decimal hours.

5 Best Practices for Time Clock Rounding

So far, we have seen the benefits and limitations of rounding payroll hours. Till now it looks like there are more challenges to it than there are benefits. So, what can we do? As always, we have your solution with the 5 best strategies and practices for work-hour rounding.

1. Determine Eligibility

First, determine whether work-hour rounding off is right for you or not. Back then, it used to be necessary as employees had to stand outside and use time cards to clock in. However, time tracking is way different now for most modern businesses.

2. Pros-Cons Balance

In some situations, time clock rounding can do more harm than good to your business. For instance, the rounded time for an employee can cross into their overtime, incurring more labor expenses for your organization. Furthermore, using it to reduce payroll costs can result in illegal rounding, harming employees’ payments. So we recommend not using it to cut budgets because you can and will face:

- Administrative penalties.

- Expensive labor lawsuits.

- Class action suits.

3. Create a Policy

Another good practice for rounding off the clocking time is to create a policy for it. It is necessary to keep it consistent so that you don’t end up stealing your employees’ legally worked hours.

4. Transparency and Fairness

Connecting to the above point, your time clock rounding policy and rules must also be transparent and fair. It means that your employees must know every detail about it. Plus, by fair, we mean that it should be in your employees’ favor and never yours.

5. Communication

The best strategy to successfully apply the rounding time clock times principles to simplify payroll is strong communication. Not only do your employees but each and everyone in your organization including HRs, supervisors, managers, and even executives and directors must know about it.

Read Also: Top 10 Best Strategic Planning Software in 2024

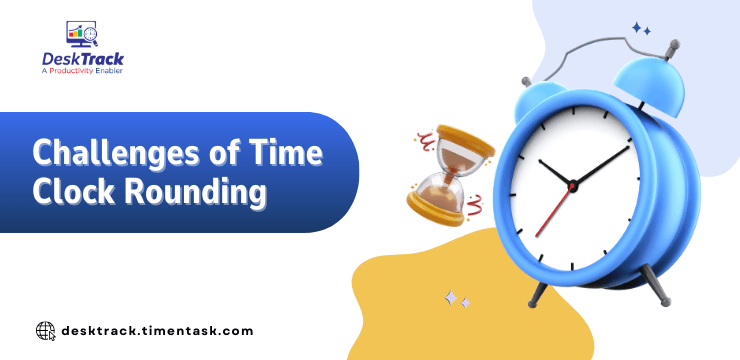

Why is Using DeskTrack Better?

DeskTrack is a time tracking, employee monitoring, project management, and productivity tracking software, which is best known for providing the most accurate results.

Here’s why it’s the best alternative to time clock rounding:

- Seamless integrations with all the other apps and tools you use.

- Direct transfer of work hours to your payroll tool for automated and accurate calculations.

- Pay your employees for the exact hour they worked with the time deviation feature between clock in and first system activity and clock out and system shut down.

- Automated calculation of idle and break hours. Plus, idle time to productive time conversion in case of meetings and other related work.

- Automated time and attendance tracking.

Conclusion

We hope that now you are clear about time clock rounding and how it simplifies payroll. As a final word, we would like to say that rounding off work hours helps you simplify complex computing due to odd minutes such as 7 minutes after 9:00. However, it needs to be done legally while following all the rules, regulations, and guidelines including that it should always be in the favor of your employees. Otherwise, you can end up facing fines, penalties, and/or lawsuits. Furthermore, it is also essential to understand the techniques of rounding off employee hours and choose the best one as per your requirements. However, work-hour rounding also has some challenges, which you need to work around in your policy. For favorable outcomes, it is wise to use the best practices and strategies for the same. Alternatively, you can also implement DeskTrack for more accuracy and efficiency.

Frequently Asked Questions (FAQ)

Q. What is Rounding Clocking Time?

Ans. Rounding the clock in and clock out times of your employees means rounding off the clock in and clock out minutes up or down. It is a way of simplifying and standardizing timekeeping for businesses and organizations.

Q. How Does Rounding Clock Time Work?

Ans. According to the most common strategy, the rounding down is 1-7 minutes to the nearest quarter hour and round up to 8-14 minutes to the nearest quarter. Other work-hour strategies include:

- 5-minute rule

- 6-minute rule

Q. Is Rounding Clock Time Legal?

Ans. Yes, rounding the clock time is legal. However, you must follow these rules and regulations. Otherwise, you can end up facing various lawsuits, penalties, and/or fines.

- The maximum rounding time is 15 minutes. You can never round up or down to let’s say 30/60 minutes.

- It must always be favorable to your employees or simply put impartial or never in the employer’s complete favor.

- Rounding in your favor means that the employee loses payment, for which they can file a wage and hour grievance complaint.

Q. What are the Best Practices for Rounding Off Work Hours?

Ans. Use these best practices to ensure that you won’t end up facing any legal charges due to wrongly rounding off employee work hours.

- Determine Eligibility

- Pros-Cons Balance

- Create a Policy

- Transparency and Fairness

- Communication