Do you always wonder why you end up earning less profit for each project, even though everything went right? The biggest reason for this to happen is an error in calculating labor costs. This is something you should be very careful about, as such mistakes can completely hinder your chances of complying with the labor laws and will be problematic when auditing. Getting your labor costs right also helps balance value for the investment you have made in your human resources.

What are Labor Costs?

When it comes to labor expenses, the first thing that comes to our mind is wages or salaries. However, it’s more than that. These costs also include other amounts, which you need to account for.

1. Direct Costs

These are costs that involve direct payment to your employees. For example, salaries, wages, etc, which are, for instance, $25/hour, $2000/month, or $3/10 shirts stitched.

2. Indirect Costs

These include expenses other than salaries and wages, such as benefits, paid time-off, etc. You don’t directly pay them to your employees. However, they are also a part of your labor expenses and must be included when you calculate labor costs.

3. Fixed Costs

These expenses never change or change in the long run. For example, if an employee is paid $50/week, they will only get paid more after they have, let’s say, at least 52 weeks of experience. As for bonuses, these are your indirect costs, if this question crossed your mind.

4. Variable Costs

As the name suggests, these labor costs vary and are less predictable. Variable costs can be the amount you pay to seasonal employees, contract laborers, and overtime.

Read Also: What is Employee Development: A Complete Guide

What are Base Rates?

Make your workday more productive

Time tracking and work management can help you reach your goals

faster.

When you sit down to calculate labor cost, the initial amount you need to know is the base rate. Simply put, it’s the per-hour amount of money you pay to your employees or workers. For example, consider a worker X getting paid $20/hour. So, your base rate is $20. Let’s say X worked for 2 hours, then you will pay them $40. It’s as simple as that. Also, base rates help you:

- Bar wage levels against local and national guidelines

- Add real burden percentages to structure accurate estimates.

- Settle rates with subcontractors or internal crews

- Adhere to labor laws, standards, and guidelines.

What is The Difference Between Base Rate & Burdened Rate?

There is also another rate called the burdened rate, which also includes the base rate. They are called burdened rates because these amounts put an extra burden on your organization. Consider them an indirect cost. However, you need to account for this, too, when calculating labor expenses:

| Category | Base Rate | Burdened Rate |

| Wage | $25/hour | $40-45/hour |

| Includes | Wages only | Wages + payroll taxes + workers’ compensation + insurance + overhead |

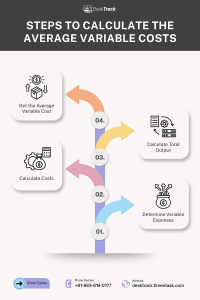

How to Calculate the Average Variable Costs?

Variable costs are a big part of your labor expenses. Thus, knowing how to calculate them first is essential. Fortunately, it only takes 4 simple steps.

1. Determine Variable Expenses

First, you need to identify all variable expenses that you must distribute to your employees. Examples include overtime, PTO, and seasonal worker pay.

2. Calculate Costs

Let’s say your total overtime pay was $25, your PTO expenses for 3 days were $100, and your seasonal worker pay was $1. Then,

- Total Variable Costs: $25 + $100 + $1 = $126

3. Calculate Total Output

This is the value you got for the money you paid to your employees or workers. For example, if 25 shirts were stitched, then the output is 25. For service-based businesses, the output is based on the hourly performance.

4. Get the Average Variable Cost

Now we are ready to calculate the average variable costs to account for our labor costs. Here’s the formula and an example.

- AVC: Complete Variable Labor Costs/ Complete Output

- $5.04/Shirt: $126/25

How to Calculate Labor Costs for Your Business?

Now that you have the average variable cost down, here are the 5 simple steps you need to calculate labor cost and percentages.

1. Identify Gross Annual Wages

As we mentioned before, wages are an important part of labor expenses. We just need one simple formula to calculate it.

- Gross Annual Wage: Annual working hours * gross hourly wage

Let’s say X works 40 hours/week with $10 hourly wage. Now, if he worked for 52 weeks, he worked 2080 hours that year. Thus:

- 20800: 2080 * 10

2. Spot Actual Work Hours

Now, a scenario where everyone worked the full 2080 work hours is totally unrealistic. So, let’s be real here and assume that our employee X took 15 days of PTO, which is equivalent to 120 hours. So, now Mr. X has worked for 1960 hours, after we subtracted the 120 hours. Applying this to our formula:

- Actual Gross Annual Wage: Actual Yearly Work Hours * Gross Hourly Wage

- 19600: 1960 * 10

3. Account for Other Expenses

Now you already know that wages are a part of labor expenses. However, they are not your full labor expenses. Let’s say his additional expenses were $100. Moreover, this is just an example. So, here’s a breakdown of all the additional costs and calculations with some practical amounts.

| Cost Category | Amount | Calculation |

| Wages | $35360 | $17/hour@2080 hours/year and actual annual work hours = 1960 |

| Social security | $2192.32 | 6.2% |

| Medicare | $513.24 | 1.45% |

| FUTA | $42 | 0.6% on the first $7000 |

| AZ state unemployment | $160 | 2.00% on the first $8000 (new employer rate) |

| Health insurance | $3120 | |

| Benefits | $1200 | |

| Overtime | $500 | |

| Meals | $500 | |

| Other expenses | $7672.40 | |

| Total labor cost | $42760 |

4. Determine the Total Yearly Labor Expenses

Now that we have our annual gross wage and additional expenses down. We just need one last calculation.

- Total Labor Costs = Annual Wages + Additional Yearly Expenses

- $19700: $19600 + $100

Now, if we divide the total labor costs for X by their hours worked according to our costs table, we get $21.82, which is higher than $17.

5. Calculate Labor Cost Percentage

After we have the total labor costs down for X, one last important value to calculate is the labor cost percentage. Here’s the formula and an example of how to calculate labor percentage.

- Labor Cost Percentage: (Total Labor Cost/Gross Sales) * 100

- 3940%: ($19700/500) * 100

| DeskTrack Fact |

| Did you know that labor cost percentages average 25-30% of your business revenue? |

How to Determine Direct Labor Costs?

Direct costs are a much essential part of your total labor expenses after you have determined the total labor costs. As crucial as it is, calculating them is much simpler. You just need 3 steps with the primary formula, which is direct labor cost per unit = direct labor hourly rate * time needed to produce one unit.

1. Identify The Direct Per-Hour Labor Rate

Use this formula to calculate the direct per-hour labor rate.

- Direct Per-Hour Labor Rate: Labor Cost/Number of Work Hours

In our example of X, it’s $10.

2. Identify the Manual Manufacturing Time

Now we need to find out the time required to manually manufacture 1 product. Here’s a simple formula and an example for it:

- Hours Required Per Unit: Total Products/Total Direct Labor Hours

- 25: 750/30

3. Calculate the Labor Costs by Product

Now all we have to do is multiply the total manual production time for 1 unit by the direct per-hour labor rate. Here’s a simple formula and example for a better understanding.

- Direct Labor Costs Per Unit: Direct Per-Hour Rate * Time Needed to Produce 1 Unit

- $250/unit: $10 * 25

Why is it Important for Businesses to understand the Labor Cost Percentage?

It is essential to understand labor cost percentages for a few reasons, including:

- Expensive Labor: Labor is costly because they are paid hourly, daily, or per piece. The higher this percentage, the higher your labor costs. So, the lower, the better. One smart way to do it is to streamline the workflow and processes via automation and hiring more salaried employees.

- Labor-Based Profitability: Directly or indirectly, your labor determines your profits. Depending on how much they work and the quality of work they provide, you will know how profitable your business is.

- It’s a Strategic Metric: Evaluating labor expenses is essential for efficient human capital management and making data-driven decisions for hiring a better-quality workforce.

Read Also: Top 10 Payroll Software for Small Businesses

How to Precisely Estimate Labor Costs & Decrease Them?

It is crucial to have a precise estimation of your labor costs to realize your actual revenue. Plus, if you can reduce labor costs, you will earn more profits. Here are some tips to do both.

- Track Historical Labor Performance: Keeping track of labor performance gives you a perfect idea of whether you are getting equal or more value for the amount you are paying them. This helps you increase or decrease the expenses to balance costs vs performance.

- Use Complete Burdened Labor Rates: Don’t forget to include burdened rates. Otherwise, you will end up just having the total wages.

- Contingency Planning: Plan for anything and everything to happen. This scenario-based planning helps you get the most accurate labor costs at the end of the day.

- Avoid Overtime: Remember this. Overtime is expensive as you pay time and a half, or simply put, 1.5 times the regular pay to your workers. Avoid overtime with the use of time tracking software, as it ensures improved work-time utilization efficiency of your employees.

- Optimize Processes & Scheduling: The less the manual work, the less the labor costs. Streamlining processes with automation, for example, digital smart screens for order booking at restaurants, reduces expenses because you have to hire fewer HR staff for the job.

- Decrease Turnover: Improving the work environment, providing more employee benefits within a budget, and celebrating achievements (with a buffet) reduce employee turnover rates and increase retention rates, leading to lower labor expenses.

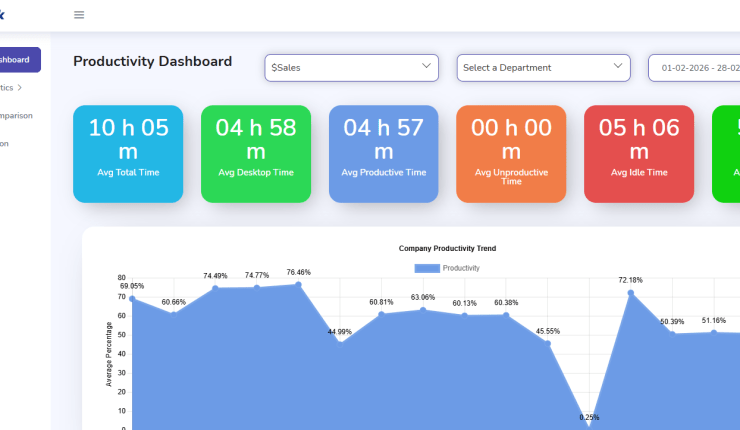

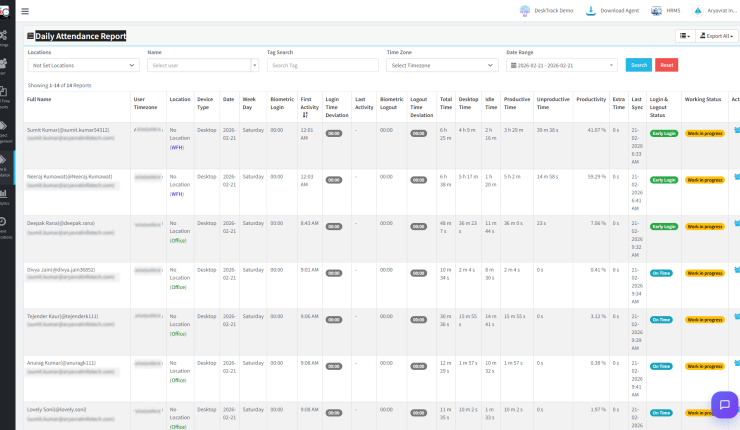

Reduce Labor Costs & Maximize Productivity with DeskTrack

So, now you know how to reduce labor costs. However, is there a smarter way to reduce labor expenses and also maximize employee productivity? With DeskTrack, it’s possible. The most unique thing about this employee monitoring software is that all its features work in real-time. It shows you the project status and work progress insights while the work happens, giving you updates from anywhere (mobile access), and at any time, ensuring that you know where you can cut costs at a glance without putting in much effort. That’s transparency with accurate tracking. Try now for 15 days and realize how businesses like yours across 100+ countries have used the tool to streamline workflows and maximize productivity.

Frequently Asked Questions (FAQ)

Q. What are Examples of Direct Labor Costs?

Ans. A worker assembling products on the line is an example of direct labor. The wages you pay to that hard-working person are direct labor costs.

Q. What are Labor Costs?

Ans. It includes the wages as the base amount with all the additional expenses, such as direct costs, indirect expenses, fixed costs, and variable costs. For example, the per-hour wages for employee X are $5. However, if additional labor expenses, including health insurance, are $40, then all this totals to $45 for X.

Q. What is a Good Labor Cost Percentage?

Ans. We can say that a 25-35% labor cost percentage against gross sales is somewhat acceptable.

Q. How to Calculate Labor Cost Per Unit?

Ans. Use this formula.

- Direct Labor Costs Per Unit: Direct Per-Hour Rate * Time Needed to Produce 1 Unit

Q. What is the Formula for Calculating Work Cost?

Ans. Use this formula.

- Hourly Wage Rate * Total Work Hours