As an employer, you continuously search for innovative ways or strategies to attract and keep the best-skilled HR. Selecting the best payroll schedule can lead to cost savings and enhanced employee satisfaction.

However, during the payroll bracket, it becomes a challenge to keep track and also manage work hours and attendance of employees. One of the best ways to overcome this problem is to shift your payroll cycle from monthly, weekly, or biweekly to semi-monthly.

There are many benefits of semi-monthly payroll, due to which businesses worldwide prefer or switch to it. These include simplified employee deductions and decreased accounting costs. Plus, it helps employees better manage their financial obligations due to regular, even-spaced paychecks.

So, in today’s blog, we will explore some basics about semi-monthly pay and even compare it to other schedules. Furthermore, at the end of the post, you will have chosen the best payroll system for your business.

What is a Pay Period?

In particular, it’s a time frame during which we track employee work hours and pay them. At the end of each pay period, bosses figure out the wages earned and provide workers with paychecks or direct deposits. The schedule:

- Helps both employers and employees effectively manage financial planning.

- Streamlines payroll processing and assists in maintaining accurate financial records for businesses, fostering a positive work culture, and contributing to overall operational effectiveness and efficiency.

Read More: Operational Planning in 2025: Key Elements and its Benefits

What Does Semi Monthly Mean?

| DeskTrack Fact |

| Did you know that 20% of American businesses pay semi-monthly? |

Semi-monthly meaning is pay schedule where employees receive their wages twice every month. This is commonly on particular dates, leading to getting paid 24 times annually. Since some months have under 31 days, some brackets are more condensed.

For example, in February, the second deposit only covers 13-14 days. However, salaried employees frequently get paid equally, with their yearly wages divided evenly over 24 checks. It is common across multiple sectors and helps employees more predictably plan their finances. Key aspects include:

- Fixed Dates: Employees and teams get paid on the same calendar dates every month. This is non-considerate of the day.

- 24 Payments: Employees get paid 24 times every year due to receiving 2 paychecks per month

- Consistent Distributions: Budgeting is simpler and more predictable due to every month including 2 pay periods.

How Does Semi Monthly Pay Work?

A semi-monthly pay schedule splits each month into 2 pay periods. Commonly bracketed as 1st through 15th and 16th through the end of the month. Your HR must process payroll for these periods twice a month on nailed dates, like the 5th and 20th or 10th and 25th of each month. Here are a few more things we thought we would cover.

- When a scheduled payday falls on a holiday or weekend, businesses pay their workers the day before to ensure timely compensation.

- This approach inspires HRs to take a thoughtful, immediate approach to payroll planning. Overall, it assists them in staying arranged and ahead of any adjustments.

So to summarize, these aspects are crucial.

- Pay Periods: Each month is split into 2 pay brackets.

- Monthly Pay: An employee’s monthly salary is cut across two paychecks.

- Yearly Paychecks: Workers will get 24 paychecks annually.

Steps to Calculate Semi Monthly Pay

To calculate a semi-monthly paycheck, or paychecks for that matter, you need a formula. Plus, you also need to calculate the hourly and daily pay amounts for this schedule:

1. Basic Formula

- Semi-Monthly Pay = Gross Annual Salary / 24

- The gross annual salary here is the total annual gross pay.

- 24 shows the full annual deposit brackets twice each month. Since each month has 2 pay brackets and there are 12 months in a year, you multiply 12 * 2 = 24.

- For Instance: $60000 / 24 = $2500. Note that this amount is before taxes and other deductions.

2. Daily

-

- Calculate the semi-monthly salary.

- Find the number of workdays in this period. Please note that a standard workweek is 5 days with around 21.67 monthly workdays based on 52 weeks/year * 5 workdays/week / 12 months. So, divide it by 2, and the result will be 10.83 working days semi-monthly.

- Now apply the formula semi-monthly salary / 10.83.

- For Instance: $3000 / 10.83 = $276.91/day.

3. Hourly

-

- Figure out the semi-monthly salary.

- Next, you require figuring out the collective 60 minutes in a semi-monthly period. For example, in America, it’s 40 hours weekly. 40 * 52 = 2080 hours/year semi-monthly hours. Next, calculate 2080 / 24 = 86.67, wage / 86.67.

- For Instance: $3000 / 86.67 = $34.61

You should also know that in the semi-monthly payroll schedule:

- Payment might vary between periods as per the number of workdays, public holidays, or overtime.

- There is a lack of a fixed average. The semi-monthly paycheck reflects real-time data.

Benefits of Semi Monthly Payroll

Choosing a semi-monthly pay period has many benefits. That too, for both the employees and the employers.

- Simplified Payroll Processing: The payroll schedule becomes straightforward enough due to a fixed annual 24-paycheck system.

- Particular Payroll Dates: The schedule is consistent.

- Simpler Monthly Budgeting: It is because it is easier to predict the total monthly payroll expenses.

- Improved Financial Stability: When employees receive their salaries twice a month, it helps avoid financial turmoil between payments.

- Better Alignment with Monthly Bills: Some bills fall on different days of the month. So, a twice-a-month salary structure assists your employees in safely keeping funds to timely meet these payments.

- Less Reliance on Credit: Employees are less likely to use credit cards or short-term loans to pay off monthly costs.

- Larger Paychecks: Each paycheck is larger than those in weekly or biweekly systems due to the annual salaries being split into fewer payments. I.e., only 24 annually, outcoming in higher individual deposits compared to a biweekly schedule.

- Lower Processing Expenses: This is due to your HRs processing fewer paychecks than weekly or biweekly schedules.

- Simpler Deductions Management: Deductions, such as retirement contributions and medical advantages, are easier to manage with 2 equal paychecks per month. This lets employees and HRs precisely track deductions annually.

Limitations of Semi Monthly Payroll

Before implementing the schedule, you also need to account for a few disadvantages of the semi-monthly pay period.

- Complexity for Hourly Employees: If you have hourly workers, it can make the calculations of hours worked unnecessarily complicated. Especially when the pay period is across parts of 2 different workweeks.

- Pay Dates Inconsistent: If the set payday falls on a weekend or holiday, you need to compensate for it by paying early or the immediate next day (although the latter is not desirable). However, it will lead to confusion or dissatisfaction among your employees.

- Reduced Cash Flow: Since these pay periods are non-aligned with weeks, the payroll amounts due at particular times of the month are higher, which burdens cash flow management.

- Longer Wait Times: Employees used to getting paid biweekly or weekly find the longer intervals between paychecks challenging. Especially if they live paycheck to paycheck.

- No Additional Paychecks: Unlike biweekly pay schedules, semi-monthly pay only offers 2 paychecks, which is only 1 less, but we decided to include this disadvantage here anyway.

- Difficulty with Budgeting: Monthly financial planning is more challenging for employees used to weekly or biweekly pay periods.

Semi Monthly Vs. Biweekly Pay

Other than what we are talking about, there is also the biweekly pay, which is another common and popular pay period among employees. For a better understanding, here’s a semi-monthly vs biweekly pay comparison table.

| Aspect | Biweekly Pay | Semi-Monthly Pay |

| Pay Frequency | Every 2 weeks, 26 yearly paychecks | Twice a month with fixed dates |

| Payday Consistency | Same day of the week | Same calendar dates each month, though the weekday varies monthly |

| Paycheck Size | Slightly smaller per check due to having more pay periods, but identical annual compensation | Slightly larger per check, since there are fewer pay periods |

| Hourly Overtime Tracking | Easier, since pay periods align with workweeks, simplifying overtime calculations | More complex, because pay brackets frequently split workweeks, needing careful tracing |

| Payroll Processing Load | More frequent. 26 runs per year skyrockets administrative overhead | Less often. 24 runs annually, decreases processing time and costs |

| Budgeting Alignment | Less aligned. Paydays shift through the month. | More aligned. Fixed dates support consistent monthly budgeting. |

Other Pay Schedules You Need to Know About

Beyond biweekly and semi-monthly payroll, businesses can choose from several other pay schedule structures that balance financial stability with organizational efficiency. Each of these provides benefits unique to different business models and workforce requirements.

1. Monthly Pay

The self-explanatory one. Here, you can expect to lose 12 paychecks per year to your employees. This is split across nailed dates each month, such as the end of the month or the start of the next. Overall, what this does is make payroll processing simple. However, due to the extended time between payments, employees need to budget carefully.

2. Weekly Pay

The number of paychecks increases to 52 per year in this one. Workers get paid weekly on the same day each week. It is best for waged workers and sectors with high turnover, as it assists in improving satisfaction and retention rates.

3. Semi-Weekly Pay

This is the one with the maximum paychecks. That is 104 per year, as employees get paid twice each week. This weird payment cycle is common in industries where immediate compensation is mandatory, such as contract staffing or commission-based roles.

However, the extreme frequency results in major administrative complexity and processing expenses. Thus, it is useful only in particular circumstances where immediate pay is mandatory for business or workforce requirements.

Is Semi Monthly Pay Right for You?

To identify whether the semi-monthly pay cycle is correct for you or not, you need to carefully analyze your business’s circumstances, workforce composition, and operational capabilities. Remember that this payment schedule is a boon for some categories of enterprises, while for others, it is a bane.

You need to take into account, worker composition first. Organizations where workers are salaried, semi-monthly pay is easily manageable than for those with hourly laborers. That’s because the fixed-date structure aligns well with monthly business cycles and expense management. Thus:

- Businesses with strong payroll systems and salaried employees and teams experience success with this schedule.

- The decreased processing frequency frees up HR for strategic planning while maintaining predictable payment timing.

Here’s what else you need to consider:

- Administrative Resources: Your payroll team’s varying pay period lengths and overtime calculations handling capacity within semi-monthly brackets.

- Industry Standards: Researching common practices in your industry to ensure competitive positioning in talent grabbing and retention is key.

- People’s Preferences: It is also crucial to survey your team to understand their financial planning preferences and cash flow requirements.

Semi Monthly Pay Best Practices

Considering the benefits and limitations of semi-monthly pay cycles, here are some best practices and tips you can implement to streamline the payment process.

- Keep Pay Dates Consistent: Maintain fixed pay dates. This repetition helps your laborers and HR professionals effectively manage budgets.

- Know the State Labor Laws: It is critical to research your state’s regulations around pay periods.

- Communicate Changes in Advance: When the regular pay dates fall on a holiday or weekend, communicating the adjusted dates to the employees in advance assists you in preventing any misunderstandings or financial inconvenience.

- Flexibility: It is also wise to establish alternative pay options for employee emergencies or unplanned circumstances outside of the semi-monthly schedule boundaries.

Streamline Time Tracking & Payroll Processing with DeskTrack

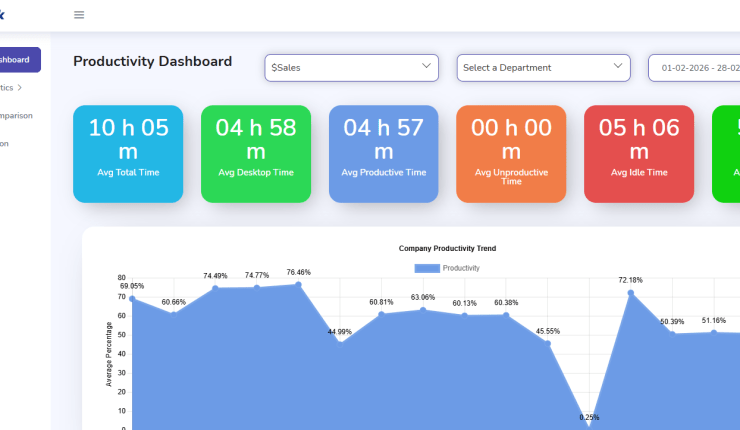

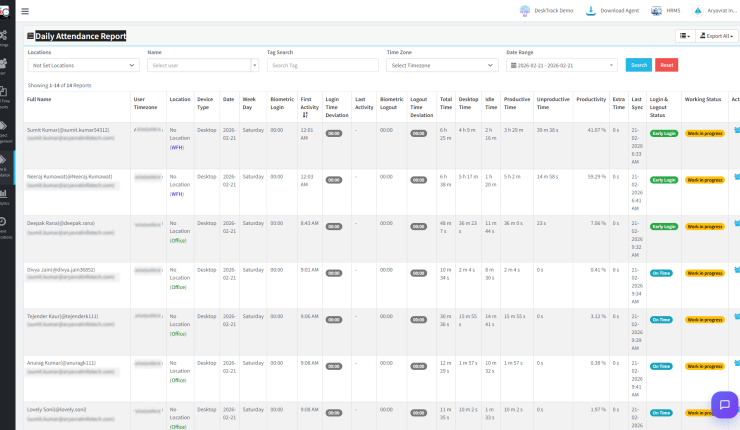

DeskTrack makes payroll processing even simpler and streamlined for your business. So whether it’s a biweekly, semi-weekly, weekly, monthly, or semi-monthly pay cycle, the tool can handle them all with seamless integrations and time tracking with data analytics automations that reduce errors to zero.

Plus, the employee monitoring capabilities of DeskTrack help you maintain accountability, responsibility, and work integrity. That is, productivity is boosted, profitability is maximized, and employees are paid fairly and on time for their efforts and hard work. Try now and find out why 8000+ organizations worldwide have implemented DeskTrack.

Frequently Asked Questions (FAQ)

Q. What is a Pay Period?

Ans. In particular, it’s a time frame during which we track employee work hours and pay them. At the end of each pay period, bosses figure out the wages earned and provide workers with paychecks or direct deposits.

Q. What is a Semi Monthly Pay Schedule?

Ans. Semi-monthly meaning is pay schedule where workers receive their wages twice every month. This is commonly on particular dates, leading to getting paid 24 times annually. Since some months have under 31 days, some brackets are more condensed.

Q. What are the Benefits of Semi Monthly Payroll?

Ans. Here’s why both employees and organizations prefer semi-monthly payroll.

- Simplified Payroll Processing

- Particular Payroll Dates

- Simpler Monthly Budgeting

- Improved Financial Stability

- Better Alignment with Monthly Bills

- Less Reliance on Credit

- Larger Paychecks

- Lower Processing Costs

- Simpler Deductions Management

Q. What are the Limitations of Semi Monthly Payroll?

Ans. Here’s why you may need to implement biweekly, monthly, or weekly pay periods.

- Complexity for Hourly Employees

- Inconsistent Pay Dates

- Reduced Cash Flow

- Longer Wait Times

- No Additional Paychecks

- Difficulty with Budgeting

Q. What are the Best Practices for Effective Semi Monthly Payroll?

Ans. Here are some tips for the same.

- Keep Pay Dates Consistent

- Know the State Labor Laws

- Communicate Changes in Advance

- Flexibility