Okay, so when you are putting people to work for you, you can’t expect free labor. That is, unless you have hired interns. Jokes aside, you will either pay a salary or a wage to the people working for you. However, which one is which? When and to whom do you pay which one? If such questions are also in your mind, you, my friend, are not alone. Fortunately, with the help of my experience and expertise, I am here to clarify all the differences between wages and salary for you. Let me get started.

What is a Wage?

You can compare a wage payment to the meals that you eat at fixed intervals during the day. When it comes to a typical workday, wages are paid and used money. There are usually many frequent payment cycles in a workday, which can be hourly, daily, or on a piece rate basis. Paid for unskilled or manual labor, these are one of the major expenses of a business and constitute a high proportion of their costs. There are 3 types of standard wages.

- Fair: The mean wage between the minimum and the living wages of an employee. Employers determine this based on their workload and capacity.

- Living: These amounts are enough to fulfill the basic needs of workers and their families. The Committee on Fair Wages defines the living wages employers must pay to their employees. This amount must cover the minimum requirements for a worker and their family to live comfortably in modern society.

- Minimum: The minimum payment employers can provide to their workers.

Read Also: Top 10 Best Gantt Chart Software for 2025

What is a Salary?

Likewise, you can compare a salary payment, which is a fixed amount, to consuming a big meal at the end of a fixed pay cycle, usually monthly, weekly, biweekly, or semi-monthly. The major difference between salary and wages is that you never get a salary on an hourly or daily basis. However, the calculation is always based on daily clock-in and clock-out times. However, a salary is always stated as annual in the aduit for some reason. For example, if an employee earns $4000/month, their record book salary is $48000/month.

How are Wages Calculated?

Calculating wages is the simplest thing you will ever do. All you have to do is set an annual pay rate. Then, you divide it by the pay period. Here’s the formula and example.

- Wage = Annual pay rate/pay period

- $30 = $1800/60 Hours

How is Salary Calculated?

Make your workday more productive

Time tracking and work management can help you reach your goals

faster.

Calculating salaries is a little complicated since they are fixed amounts paid at the end of a pay period and not based on hours worked. Factors like the employee’s job role, performance, and hierarchy determine their salary. Here’s the formula and an example.

- Gross Salary = CTC – EPF – Gratuity

- $40000 = $50000 – $5000 – $5000

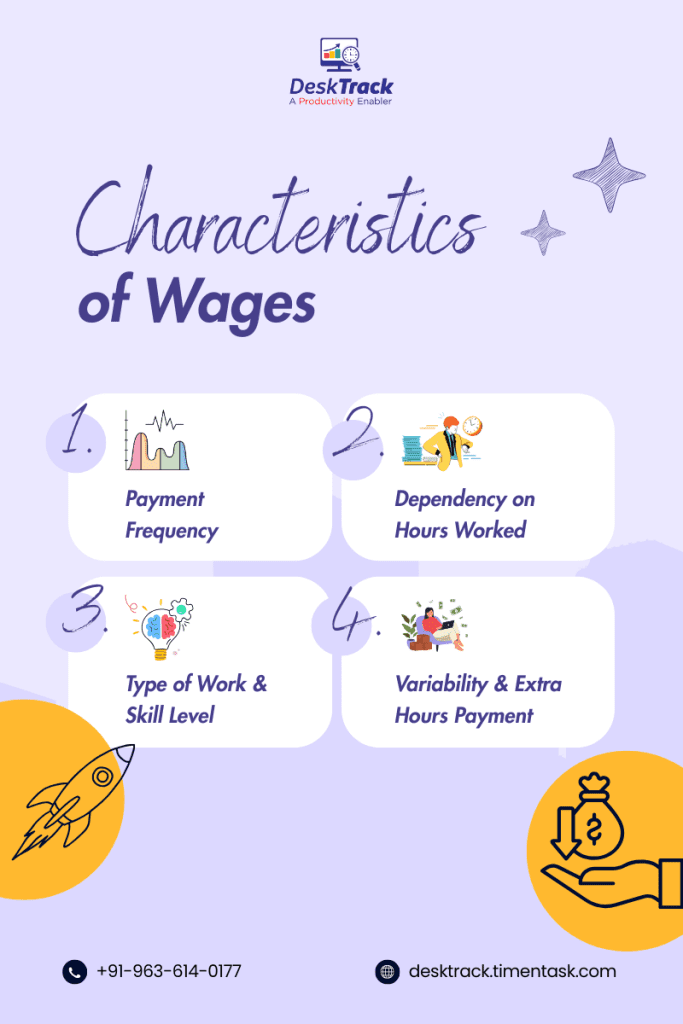

Characteristics of Wages

To become familiar with the difference between wages and salary, you need to know the characteristics of both. Let me decode wages first.

1. Payment Frequency

As I mentioned before, wages are paid on a daily, hourly, or piece rate basis. That’s more expensive for businesses as it’s a major part of their costs.

2. Dependency on Hours Worked

Wages are highly dependent on the hours worked. There is only one exception to this. That is, if you are paid, let’s say, $2 for every pen you sell. For example, if the per-hour rate is $30, you will get $15 for working for half an hour.

3. Type of Work & Skill Level

Usually, wages are paid to unskilled workers or manual laborers. This may seem like a feasible idea at first. However, at the end of the year, it adds up a lot to your overall costs.

4. Variability & Extra Hours Payment

The amount of wages can vary from person to person or fluctuate between pay periods depending on various factors. However, there is no role of overtime pay here because every worker is paid based on the number of hours worked.

Characteristics of Salary

When it comes to salaries, the scenarios and other factors change a lot. So, let’s get right to the bottom of it.

1. Fixed Payment Intervals

Salaries are usually paid at the end of fixed pay cycles, such as monthly or weekly. Some exceptions include commission-based salaries, which can be paid either hourly or daily.

2. Independent of Hours Worked

No matter how many hours you work, it won’t affect your salary. That’s the major difference between wage and salary. However, what affects your salary is the number of leaves you take, your overtime hours, and the number of half days you take between 2 pay periods.

3. Type of Work & Skill Level

The skill level varies between freshers and experienced candidates. However, manual laborers and unskilled workers only get paid with wages.

4. Benefits, Leaves & Job Security

Salaried work is more secure than jobs that pay wages. Especially if you are working in the government sector. On top of that, salaried employees get other benefits too, such as healthcare. However, what interests employees in salaried jobs the most is that they can take PTOs and sabaticals as well to refresh and rejuvenate.

Key Differences Between Wages & Salary

Too long? Didn’t read? No worries. I have summarized the difference between salary and wages for you below.

| Aspect | Wages | Salary |

| Payment structure | Paid daily, hourly, or based on a per-piece basis | Paid weekly, monthly, semi-monthly, or biweekly |

| Skill requirement | Manual or unskilled labor | Usually experienced and qualified employees |

| Employer costs | High | Low |

| Performance evaluation | Simple. You will get paid according to the quality of work or the quantity of products sold | Complicated. Your employer considers many things, such as your productivity levels, the value you add to the business, and your punctuality. |

| Types | Fair, living, and minimum | Depends on the type of work and pay cycle |

| Resignation formalities and notice period | You can stop working whenever you want. You just need to inform your employer in some cases. There are no formalities or notice period. | You need to submit a resignation letter to your employer and must serve a notice period of at least 1 month or till your replacement has been hired |

| Job examples | Construction workers | Software development is an example of a salary |

Read Also: What is PMIS & How Does it Work?

Salary Vs. Wages: Pros & Cons

Both wages and salary come with their benefits and limitations. Understanding these will help you choose or provide the right job.

| Payment Mode | Pros | Cons |

| Salary |

|

|

| Wages |

|

|

Which One Is Better? Salary or Wages

So, after the comparison between wages and salary is done, one question comes to my mind. Which payment structure is better for you? To answer it precisely, it mainly depends on the type of work you need. However, I would also consider other factors, such as the costs, government guidelines, and infrastructure of my business.

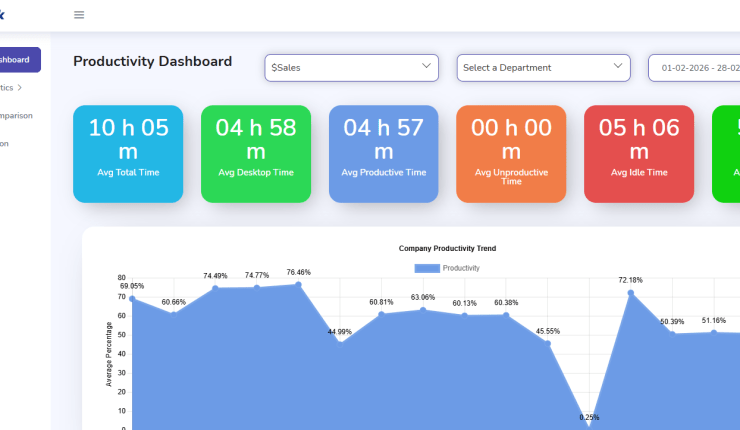

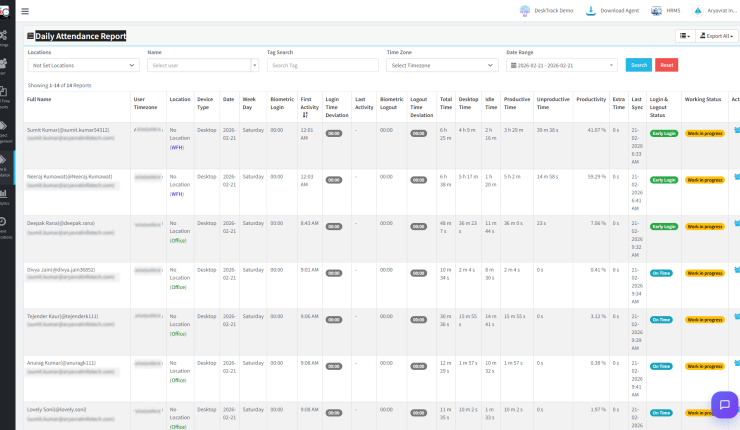

Maximize Payroll Accuracy with DeskTrack

Now, I hope that you have wrapped your head around the difference between salary and wages. However, even after having all this knowledge, calculating salaries and wages is much complicated and time-consuming. So, is there a way I can automate it all? Yes, I can. You can too. With DeskTrack’s payroll integration and automatic time tracking, data analytics, and work-hour categorization functionality, there will be minimal to no calculation, improved accuracy, time saved, and more employee satisfaction. Try now, and realize why it’s the only time tracking software you will ever need.

Frequently Asked Questions (FAQ)

Q. What Do You Mean By Wages?

Ans. When it comes to a typical workday, wages are paid and used money. There are usually many frequent payment cycles in a workday, which can be hourly, daily, or on a piece rate basis. These are paid for unskilled or manual labor.

Q. What is the Minimum Wage?

Ans. The minimum wage is the minimum payment employers can provide to their workers.

Q. How Do We Calculate Wages?

Ans. All you have to do is set an annual pay rate. Then, you divide it by the pay period. Here’s the formula and example.

- Wage = Annual pay rate/pay period

- $30 = $1800/60 Hours

Q. Is Wage the Same as Salary?

Ans. No, the major difference between salary and wages is that you never get a salary on an hourly or daily basis. However, the calculation is always based on daily clock-in and clock-out times. However, a salary is always stated as annual in the aduit for some reason.

Q. What is the Difference Between Wages & Salary?

Ans. Here’s how these payment modes are different from each other.

- Wages are paid daily, hourly, or based on a per-piece basis. Salaries are paid weekly, monthly, semi-monthly, or biweekly.

- Manual or unskilled labor gets wages. Usually, experienced and qualified employees get salaries.

- Employer costs are high when calculating wages. The costs are low when calculating salaries.

- Performance evaluation is simple for waged workers. However, it’s complicated for salaried laborers.

- Wages are either fair, living, or minimum. However, the salary depends on the type of work and pay cycle.

- Resignation formalities and notice period

- You can stop working whenever you want as a waged worker. However, as a salaried employee, you need to submit a resignation letter to your employer and must serve a notice period of at least 1 month or till your replacement has been hired.