We can explain the sunk cost fallacy as the common mob mentality of us tending to continue investing time, money, and effort into something that’s not giving us any results. That’s because we had already boarded the sunken ship. Simply put, it’s all about how our brains function. However, more on the psychology behind the concorde fallacy later.

Whether in our personal lives or business, understanding and preventing sunken cost fallacy from happening is a big step towards success. Another short, simple, and sweet sunk cost fallacy definition can be of an investment cycle that we have made ourselves, which only stops when we have nothing to lose.

Getting out of this loop proactively is essential, and in today’s blog, we will tell you how to do that, too. However, first, what is a sunk cost?

What is a Sunk Cost?

A sunk cost is an irrecoverable expense. In layman’s terms, we can compare it to non-refundable payments. For instance, the past cash, which is gone forever, such as the investment made into your new enterprise or the hours you have dedicated to a bond. Logically, they are not relevant to our future decisions. That’s because our decisions must be estimated future costs and business goal-based, not old irreversible investments. For instance:

- Opportunity costs

- Effort

- Mental strain

- Overhead and facilities

- Equipment and material

- Investments

- Annual subscriptions

- Non-refundable business costs

Read Also: The Eisenhower Matrix: Your Complete Guide to Prioritizing To-Do Lists

What is the Sunk Cost Fallacy?

Make your workday more productive

Time tracking and work management can help you reach your goals

faster.

As we mentioned before, the sunk cost fallacy is the common mob mentality of us tending to continue investing time, money, and effort into something that’s not giving us any results. It’s a common mistake in life and business, and can even explain unimportant things, such as continuing to watch a boring movie that you have bought, or even serious situations like your refusal to terminate a failing business investment. Overall, falling into this investment loop makes us make bad and illogical decisions that are against our best interests.

- Being committed to a relationship even though it’s not working between you two, because you have so many memories together.

- Thinking that you can’t change your essay title because you have invested so much time into it.

- Not resigning from your unsatisfactory job because of all the training you underwent for months or even years.

- Staying dedicated to studying your chosen course even if you know that it will not lead to your desired career path, because you have already attended several classes.

The Psychology Behind Sunk Cost Fallacy

As we mentioned before, it’s all an investment loop, and here’s the psychology behind bad investment decisions.

1. Loss Aversion

The thought of losing something is stronger than actually winning it. For example, winning ₹100 feels satisfactory, but losing ₹100 feels like a nightmare. Isn’t it? Thus, we will try everything in our power not to lose, even if it means not winning at all. In the context of the sunk cost fallacy, this makes us keep poor investments because we don’t want to feel bad about losing.

2. The Framing Effect

This is when you pick options based on whether they are positive or negative. In the case of the concorde fallacy, it happens that we will follow through with a decision and present it as successful. On the other hand, when we don’t follow through, we presume failure. Even if it was illogical. Suppose you started a blog campaign and realized midway that it was a bad investment. The logical choice is to invest elsewhere. However, in our heads, the campaign is a success, even though it’s not attracting the expected traffic.

3. Unreal Positivity

According to behavioral economics, unrealistic optimism is when you think that you are less likely to experience a negative event than others. Simply put, you will underestimate your losing probability and overestimate your winning probability, especially if there is some monetary investment involved. For instance, if you invest a lot of money in a new business, you will believe it to profit without any evidence to back up your claim.

4. Personal Responsibility

When you feel responsible for past expenses, you are more likely to jump into this investment loop, which is the sunk cost fallacy definition. Simply put, it’s easier to change someone else’s decision but a lot harder to change your own, especially if it’s a personal investment. This is the most problematic for decision-makers and project creators. Speaking of which, you can use the best project management software to ensure that you at least get your investment’s worth.

5. No One Wants to Appear Wasteful

You might continue with your bad investment decisions because of feeling bad about wasting money. For example, you go to an expensive restaurant only to realize that the food was terrible. However, you will still eat it for 2 reasons. Firstly, you feel regretful about wasting money, and secondly, you don’t want others in the restaurant to think that you are wasteful. Plus, another example is continuing to use a paid software solution that’s not working for your team. It will only lead to the productivity fallacy.

Is the Sunk Cost Fallacy Bad for Your Business?

Simply put, the sunk cost fallacy can be a big problem for your business, especially if you let it influence your decisions, leading to irrational decision-making. Instead of using logic, we simply keep on adding more to our commitments. As we mentioned before, we keep on investing money, time, and effort into something that is not beneficial for us. The more the investment, the higher the escalation of commitment and wasted time, and resources.

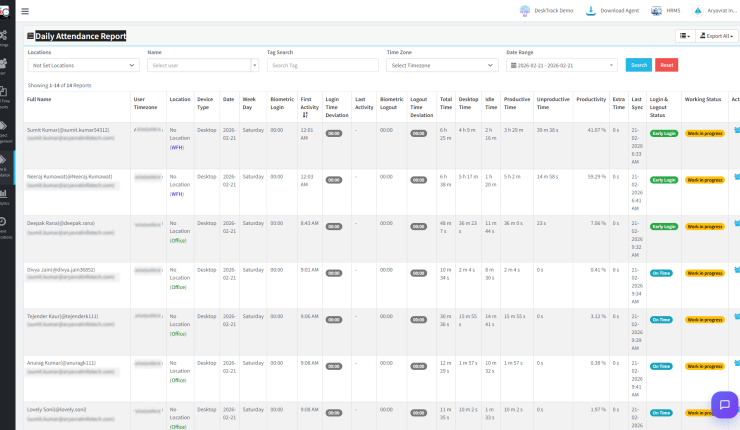

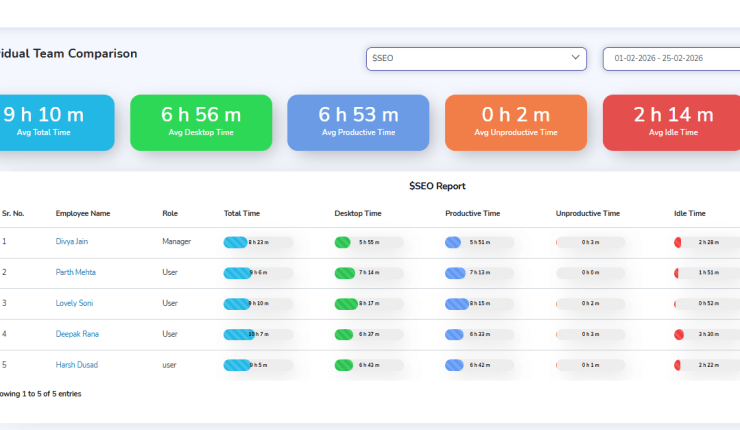

On the other hand, our business psychology says that investing in the best employee monitoring software is the best decision.

Read Also: Top 15 Time Tracking Software for Freelancers

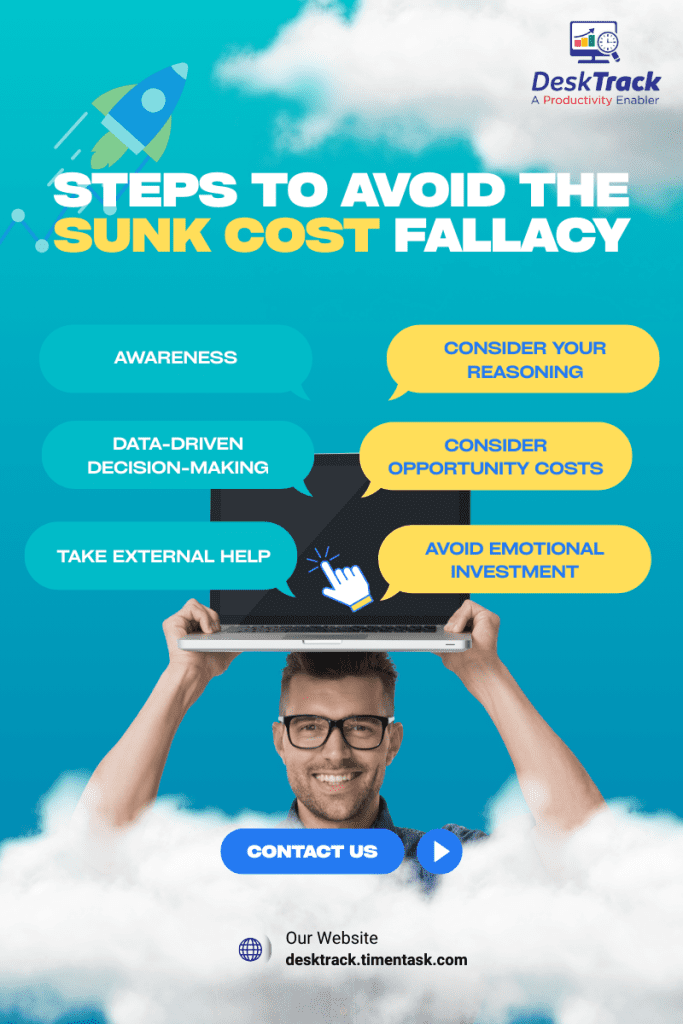

Steps to Avoid the Sunk Cost Fallacy

Avoiding sunk costs and over-investing in failed projects is much simpler and easier than it sounds. You may already know how to do it. So, we will just remind you of how with implementation tips.

1. Awareness

Just being wary of the sunk cost fallacy is the first step towards avoiding it. Since you now understand what it is and how it works, you can easily check for cognitive biases by asking yourself the following questions.

- What are you afraid of losing? How is that fear stopping you from making the correct decision?

- How will you describe success and failure for this scenario? Is it even making sense?

- What are the chances of your venture succeeding?

- What would you do if someone else decides to invest? What advice will you give them?

- Are you afraid of being wasteful to yourself or others? Is your fear even relevant?

2. Consider Your Reasoning

What is your reason behind the investment? If you are prioritizing future costs and benefits, then it’s okay. However, if you are dedicated to a past investment or commitment, even if it’s not beneficial anymore, then it’s not good. Overall, it is essential to account for new data or evidence when making a big decision.

3. Data-Driven Decision-Making

Various examples of sunk cost fallacy prove that there is no place for logic in it. The solution, though, is not as complicated as you think. All you have to do is bring back logic by making data-driven decisions. One way is to use time tracking for better decisions. Other ways include:

- Set Investment Goals

- KPI Tracking

- Create a Decision Matrix

- Strategize

4. Consider Opportunity Costs

You need to consider the crucial loss from continuing to invest in failed projects. If there is a better opportunity, simply grab it.

5. Take External Help

Just like you are reading this blog on the sunk cost fallacy, which is external help, you must also take other external help from experts in this field, whenever possible.

6. Avoid Emotional Investment

When you are emotionally invested in a project, your mind will subconsciously ignore everything else, even if in reality, you are failing. Simply seek advice from non-emotionally invested people, as it can open your eyes (really wide) and help you make informed decisions.

Implement DeskTrack to Eliminate Sunk Cost Fallacy

Investing in DeskTrack’s powerful employee monitoring software in itself is the best decision ever. Instead of the sunk cost fallacy, you will experience:

- Prevented insider threats because of the real-time screenshot tracking feature.

- Streamlined workflows with real-time app, URL, and file usage tracking.

- You will also know which projects are fruitful due to the project management feature, which lets you see how your teams are handling the workload and provides useful insights with time data, which tells the actual reason behind the delays.

Try now and see why 8000+ businesses around the world are already using it.

Frequently Asked Questions (FAQ)

Q. What is the Sunk Cost Fallacy?

Ans. The sunk cost fallacy is the common mob mentality of us tending to continue investing time, money, and effort into something that’s not giving us any results. It’s a common mistake in life and business, and can even explain unimportant things or even serious situations.

Q. What is Another Word for Sunk Cost Fallacy?

Ans. It is also known as the concorde fallacy.

Q. What is an Example of Sunk Cost Fallacy?

Ans. Here are 4 relatable examples for you.

- Being committed to a relationship even though it’s not working between you two, because you have so many memories together.

- Thinking that you can’t change your essay title because you have invested so much time into it.

- Not resigning from your unsatisfactory job because of all the training you underwent for months or even years.

- Staying dedicated to studying your chosen course even if you know that it will not lead to your desired career path, because you have already attended several classes.

Q. What is the Psychology Behind the Sunk Cost Fallacy?

Ans. These are the psychological reasons behind the sunk cost fallacy according to behavioral economics.

- Loss Aversion

- The Framing Effect

- Unreal Positivity

- Personal Responsibility

- No One Wants to Appear Wasteful

Q. How to Break Out of the Sunk Cost Fallacy?

Ans. You will need these 6 steps.

- Awareness

- Consider Your Reasoning

- Data-Driven Decision-Making

- Consider Opportunity Costs

- Take External Help

- Avoid Emotional Investment