Don’t confuse vacation pay with paid time off. The latter is off the charts in this blog. As the name suggests, you calculate holiday pay as the amount you pay your employees for working on certain federal holidays. In short, we can say it’s an incentive that keeps your business running, especially during peak demands. Typically, this incentive pays higher than the employee’s regular pay. Sometimes, it’s even twice or even thrice what they receive on a typical workday.

What is Holiday Pay?

As we mentioned earlier, vacation pay is an incentive you may offer your employees for working on holidays. This so-called bonus or employee benefit is paid higher rate than the regular pay rate, even twice or thrice. However, typically, it’s 1.5 or 2 times more. Moreover, since non-exempt employees are already getting overtime and double time, they usually don’t receive holiday pay.

How Does Holiday Pay Work?

According to the US Bureau of Labor Statistics, every 4 out of 5 employees receive holiday pay. However, the good part for employers is that the FLSA doesn’t force them to pay holiday entitlement to employees for working for them on holidays instead of spending time with their families, which they rightfully deserve. Nonetheless, businesses offer extra compensation to employees for working on holidays. However, you should know that the requirements differ for government employees and workers in Rhode Island. Here are a few more things you need to know.

- Federal workers must receive vacation pay for Inauguration Day and the 11 federal holidays, which the US government has mandated.

- Rhode Island is the only state where holiday entitlement is mandatory. It requires a premium rate for non-exempt employees who work on certain holidays.

- Private businesses, such as yours, don’t need to offer holiday pay to employees. Besides, you don’t even need to observe federal holidays. However, if you do pay your employees for working on holidays, you have the flexibility to select which holidays to include.

- Your holiday entitlement policy can also include different qualifying criteria for full-time, seasonal, and part-time employees.

Nonetheless, whatever you do, be sure to include your vacation pay policy in the employment agreement. Overall, holiday pay ensures fair compensation for your employees and accrues labor cost calculations.

Non-Exempt Vs Exempt Employees

Holiday work pay works differently for exempt and non-exempt employees. Here’s what you must know.

|

Usually, salaried and are not eligible for overtime pay. They receive complete pay, ineffective of the holidays they take or the hours they work. These workers get their salary as vacation pay for the holidays they work. |

|

They are usually hourly wage workers who are eligible for overtime pay and may receive holiday pay if the organization they work for allows it. |

Read Also: Will Artificial Intelligence Ever Replace Human Intelligence?

How is Holiday Pay Calculated?

To calculate holiday pay, you need to know the holiday premium, which is usually 1.5 or 2, your employee’s hourly rate, and the total holiday work hours for every worker who worked on the holiday. Let’s say, employee Y worked on Christmas for 5 hours and their holiday rate is $10/hour at a premium of 2, then they will receive $100 for working on 25 December. Here’s how the calculation goes.

- Employee Hourly Rate * Holiday Premium * Hours Worked on the Holiday = Vacation Pay

- $10/Hour * 2 * 5 = $100

That was just an example of how we calculate holiday entitlement. However, you have the whole and sole right to decide the premium. You can make it as low as 0.1 or as high as 10. It’s totally up to you and your conscience.

How to Calculate Holiday Pay for Different Working Patterns?

To calculate holiday entitlement for different working patterns, you need to keep a few things in mind, including:

1. Fixed Hours

If an employee works fixed hours for you, their regular pay rate comes into play when calculating holiday entitlement. This is regardless of whether they work part-time or full-time.

2. Hours Changed Mid-Year

Sometimes an employee may switch to part-time for no reason at all while working for you. In such a case, you need to recalculate the holiday entitlement from that date. However, the date the change occurred will not affect any vacation pay before the said date.

3. During the Job’s First Year

An employee may also be able to get average holiday pay during the first year of their job if you allow it in the employment contract. However, if you and your employee talk it out and you agree on their terms, it is possible under certain conditions as well, such as the laborer’s probation period.

Benefits of Vacation Pay

There are many obvious benefits of incentivizing employees with some form of bonus payment for working on holidays. Some of these include:

- Improved productivity

- Increased motivation

- Boosts employee loyalty

- Makes your work environment positive

- Increased employee satisfaction

Read Also: Top 10 Team Collaboration Tools for Remote Teams in 2026

How to Make Your Employee Holiday Pay Policy

The thing is that your vacation pay policy must be included in the employment contract, ensuring that there are no disputes. To ensure that this does happen, we would follow 4 simple steps.

1. Define Holidays

The FLSA doesn’t mandate you to pay your employees for working on holidays. However, if you are kind enough to compensate them for that, then you need to decide which holidays will count under your policy. Here’s a reference US holiday list to help you out.

| Typical Paid Holidays | Other Holidays |

|

|

2. State Eligibility

Next, you need to define who’s eligible and who’s not. Usually, it will be full-time employees who dedicate 40 hours per week to your vision. However, it’s totally up to you if you also want to include part-time and seasonal workers.

3. Set Your Calculations

Although commonly the premium is 1.5 or 2, it’s totally up to you how generous you want to be. As we mentioned before, your premium can even be as high as 10. Then, use this formula to calculate holiday pay for your employee. In our case, employee Y gets.

- Employee Hourly Rate * Holiday Premium * Hours Worked on the Holiday = Vacation Pay

- $10/Hour * 2 * 5 = $100

4. Let Your Employees Know

That’s very important. Otherwise, it may cause dispute or conflict. The smartest thing to do to be transparent is to include the policy in the employment contract and encourage all new joiners to carefully read their contracts before signing.

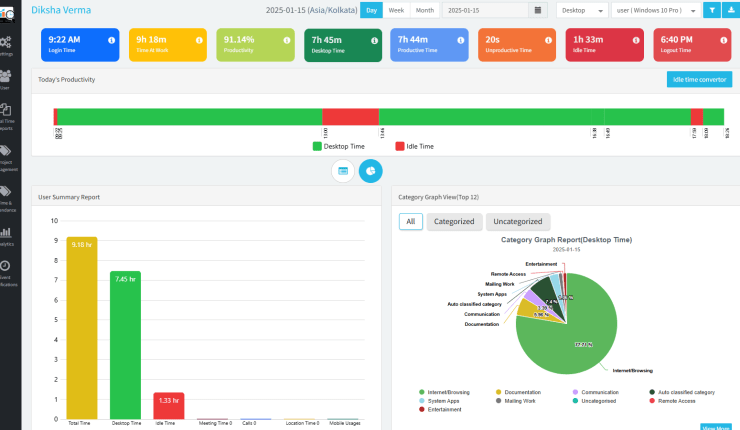

Streamline Your Payroll Processes with DeskTrack

Calculating holiday work entitlement can get complicated if more than one workers work simultaneously on the same holiday or different holidays. Plus, calculating regular salaries, along with this, can take a toll on your HR professionals. However, there is a simple solution for you. That is, DeskTrack’s attendance management and time tracking software that seamlessly integrates with your payroll systems, streamlining the entire process. Its customizable features that work in real-time keep you updated on who is working on a holiday, who is on leave, how many hours they worked, and everything else you need for accurate payroll calculations. Implement now and ensure error-free time tracking and attendance monitoring.

Frequently Asked Questions (FAQ)

Q. What is Holiday Pay?

Ans. Vacation pay is an incentive you may provide your employees with for working on holidays. This so-called bonus or employee benefit is paid higher rate than the regular pay rate, even twice or thrice. However, typically, it’s 1.5 or 2 times more.

Q. Is It Illegal for a Job to Not Pay You Holiday Pay?

Ans. The FLSA doesn’t mandate employers to pay their workers for working on a holiday. So, it’s technically not illegal for you to be forced to work for free on a holiday. However, if your employment contract outlines holiday entitlement, and if you don’t get paid for working on a vacation, then it’s illegal, and you can complain to your state’s labor board.

Q. How Much is Holiday Pay for $20 an Hour?

Ans. It depends on the number of work hours your employee worked on the holiday and your holiday work premium. For example, your premium is 1.5 and the said holiday worked for 2 hours on a holiday, then:

- Employee Hourly Rate * Holiday Premium * Hours Worked on the Holiday = Holiday Pay

- $20/Hour * 1.5 * 2 = $60

Q. What Can You Do If You Think Your Vacation Pay Should be Different?

Ans. Here are the steps to follow.

- Check your employment contract. It makes it clear how your pay is calculated.

- If you still think that you are not getting as much holiday pay as you are entitled to, or if you are unsure how it’s calculated, talk with your employer.

Q. Can You Complain about Being Underpaid for Holiday Work?

Ans. If you think that you are being underpaid for working on holidays, you can complain to an employment tribunal. However, there are strict rules for this as well, usually 3 months – 1 day from receiving the most recent vacation pay.